Living with HIV no longer means life insurance is out of reach.

Thanks to advances in treatment and insurers’ better understanding, securing coverage is now easier and more affordable than ever.

While traditional policies may have been difficult to obtain in the past, many providers now offer options at near-standard rates for individuals with well-managed HIV.

The Chimat team will explain everything you need to know about HIV life insurance and help you find the right policy for your needs and budget.

Life Insurance For People With HIV Starts From Only £6 Per Month. Compare Plans From Leading UK Insurers Today.

Can You Get Life Insurance If You Have HIV?

Yes, life insurance for people with hiv is possible through Chimat Life.

While it was once nearly impossible to secure coverage, significant advancements in medical treatments and a better understanding of the condition have led insurers to offer more inclusive policies.

This is in part due to Triple Therapy (HAART) treatment, which enabled many UK life insurance providers to offer coverage to people with HIV.

Today, many individuals living with HIV can obtain life insurance at rates that are much closer to standard premiums, especially if their condition is well-managed.

The availability of HIV life insurance has also grown due to improvements in antiretroviral therapy (ART), which helps individuals maintain undetectable viral loads and live long, healthy lives.

As a result, insurers now view HIV as a chronic but manageable condition rather than an immediate high-risk factor. This shift has led to more policy options, fewer outright declines, and a wider range of insurers willing to provide cover.

However, while life insurance for HIV patients is available, applying for a standard policy is not always straightforward. Each insurer has different underwriting criteria; some may be more accommodating.

That’s why working with a specialist broker – like Chimat Life – can make all the difference.

We have access to various insurers, including those offering coverage specifically designed for individuals with pre-existing conditions.

Click To Compare QuotesIf you’ve previously been turned down for life insurance due to your HIV status, it’s worth reassessing your options. With the right guidance, you will likely find policies that fit your needs and budget.

How Does HIV Affect Life Insurance Applications?

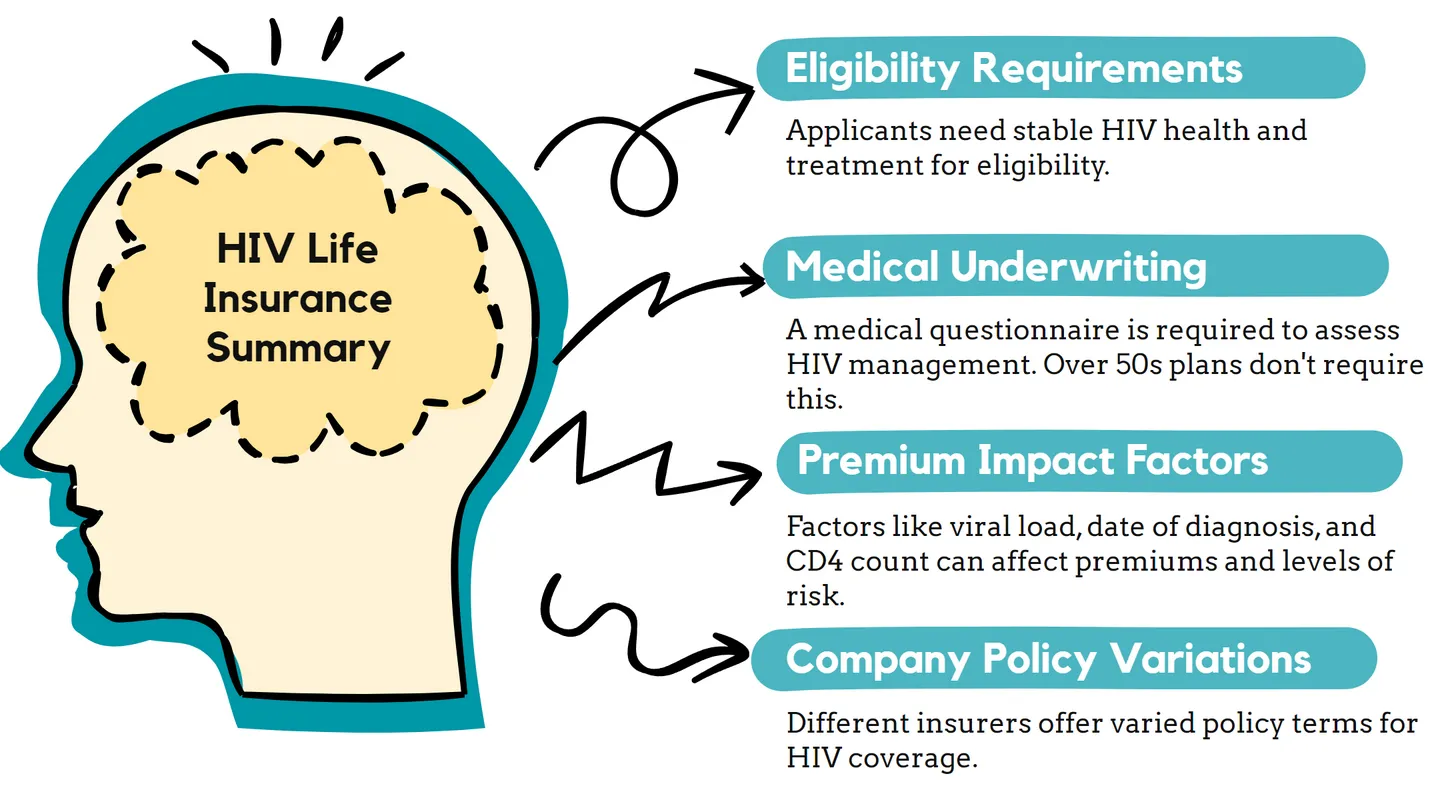

When applying for life insurance, insurers assess risk based on several factors, including overall health, medical history, and lifestyle. For people living with HIV, the underwriting process is more detailed, but that doesn’t mean getting covered is impossible.

Insurers now recognise that with proper treatment, people with HIV can live long, healthy lives. However, they still evaluate certain key factors when determining eligibility and pricing.

Viral Load & CD4 Count

Your viral load (the amount of HIV in your blood) and CD4 count (a measure of immune system strength) are two of the most critical factors insurers look at.

A consistently undetectable viral load and a CD4 count above 350-500 demonstrate that your condition is well-managed, making you a lower-risk applicant.

If your viral load is detectable or your CD4 count is low, insurers may be more hesitant, but coverage can still be available through specialist providers.

Treatment Adherence

Obtaining coverage often requires being on antiretroviral therapy (ART) for at least six to twelve months.

Insurers want stability in your treatment regimen, meaning no missed doses and no recent medication changes due to complications.

Some insurers may require you to wait before applying if you’ve recently been diagnosed and haven’t yet stabilised your treatment.

General Health & Lifestyle

Beyond HIV, insurers assess your overall health. Factors like weight, blood pressure, cholesterol levels, and whether you smoke all play a role in determining premiums.

Smoking, in particular, can lead to significantly higher costs, as it increases the risk of other health complications.

If you have other medical conditions, such as diabetes or heart disease, insurers may evaluate how well those are managed alongside your HIV.

Age & Policy Type

The younger you are when applying, the more affordable your premiums will likely be.

Term life insurance (which lasts for a specific number of years) is often more accessible than whole of life policies (which guarantee a payout whenever you pass away).

Time Since Diagnosis

Some insurers require applicants to have been diagnosed for a certain period, often at least one year, to ensure stability in their condition.

If you were only recently diagnosed, waiting until you’ve established a strong treatment record before applying might be beneficial.

Types of Life Insurance Available for People with HIV

Choosing the right type of life insurance is essential to ensuring financial security for your loved ones.

Click To Compare QuotesThe good news is that there are multiple options available for individuals with HIV, and with the right policy, you can gain peace of mind knowing that your family will be financially protected.

Below, we break down the different types of life insurance available to you, along with their benefits and considerations.

Term Life Insurance: The Most Accessible & Affordable Option

Term life insurance provides coverage for a set period, such as 10, 20, or 30 years. If you pass away within the term, your beneficiaries receive a payout, and if you outlive the policy, there is no payout unless you renew or take out a new policy.

Pros:

- Generally more affordable than whole of life insurance.

- Available to individuals with well-managed HIV at competitive rates.

- Flexible terms allow you to choose coverage based on your financial needs.

Cons:

- There is no payout if you outlive the policy term.

- Renewing or reapplying at an older age can increase premiums.

For most people with HIV, term life insurance is the best choice as it provides financial protection during key life stages, such as paying off a mortgage or raising children.

Whole of Life Insurance: Lifetime Coverage, But Higher Costs

Whole of life insurance guarantees a payout whenever you pass away as long as you continue paying your premiums. This type of policy is typically more expensive than term life insurance due to its lifelong coverage.

Pros:

- Guaranteed payout to beneficiaries.

- It can be used for inheritance planning or funeral expenses.

Cons:

- Significantly higher premiums, especially for applicants with pre-existing conditions.

- Fewer insurers offer whole of life policies to people with HIV.

Because of the cost, whole of life insurance is not always the best choice for those with HIV unless there’s a specific need for lifelong coverage.

Critical Illness Cover: May Be Available in Some Cases

Critical illness cover pays out a lump sum if you’re diagnosed with a serious illness listed in your policy. In the past, HIV was often excluded from critical illness policies, but some insurers available through Chimat are now more flexible.

Pros:

- Provides a payout if you’re diagnosed with another serious illness (e.g., cancer, stroke, or heart attack).

- This type of coverage can help cover medical expenses or lost income if you become too ill to work.

Cons:

- HIV is usually excluded from critical illness payouts, but some insurers will consider it.

- Policies can be expensive and have strict eligibility criteria.

Income Protection Insurance: Replacing Lost Income If You Can’t Work

Income protection insurance provides regular payments if you’re unable to work due to illness or injury.

Insurers now offer income protection policies to individuals with HIV, provided their condition is stable.

Pros:

- The coverage helps to replace lost income if you’re unable to work due to health issues.

- It can provide financial security for those who rely on their salary.

Cons:

- HIV-related illnesses may be excluded from claims, depending on the insurer.

- Some insurers may require additional medical underwriting.

If protecting your income is a priority, working with a specialist broker can help you find an insurer willing to provide the best life insurance for hiv patients coverage.

At Chimat Life, we specialise in helping individuals with pre-existing conditions, including HIV. We work with a range of UK insurers, ensuring you get the best coverage at the most competitive rates.

How Much Does HIV Life Insurance Cost?

The cost of life insurance with HIV varies based on several factors, including overall health, treatment history, and lifestyle.

While premiums may be higher than for someone without a pre-existing condition, the good news is that with well-managed HIV, many people can now secure coverage at near-standard rates.

Click To Compare QuotesIf you’ve previously been quoted excessively high premiums – or denied coverage altogether – it’s worth exploring your options again, as insurers have become more flexible in recent years.

Below, we explain the key factors that influence pricing and how you can secure the most affordable policy.

Key Factors That Affect HIV Life Insurance Premiums

Health Stability & Treatment Adherence

- Insurers prefer applicants whose HIV is well-managed with antiretroviral therapy (ART).

- You will likely receive lower premiums if your viral load is undetectable and your CD4 count is high.

- Consistency in treatment (without recent medication changes) is a sign of stability, which insurers view positively.

Age at the Time of Application

- Like all life insurance policies, the younger you are, the lower your premiums.

- If you apply while in your 30s or 40s, you’ll likely receive better rates than waiting until your 50s or 60s.

Policy Type & Coverage Amount

- Term life insurance is generally more affordable than whole of life insurance because it covers a specific period rather than guaranteeing a payout.

- The higher the coverage amount, the higher the premium. Choosing a policy covering your essential needs (e.g., mortgage, family expenses) can make costs manageable.

Smoking & Lifestyle Choices

- Smokers pay significantly higher premiums than non-smokers. This applies to everyone, but it’s particularly relevant for those with HIV.

- Other lifestyle factors, such as dangerous hobbies or high-risk occupations, may also affect costs.

- Users of drugs (PWID), particularly intravenous injections of class A narcotics such as heroin, will likely be required to take an HIV test.

Time Since Diagnosis

- Some insurers require you to be diagnosed for at least 6–12 months to prove your condition is stable.

- If you were diagnosed recently, it may be worth waiting a little longer before applying, as insurers prefer applicants with a longer history of stable health.

How Chimat Life Can Help

Finding life insurance when you have HIV can feel stressful, but at Chimat Life, we make the process simple.

We specialise in securing life insurance coverage for people with pre-existing conditions, working with leading UK insurers that offer fair pricing and flexible policies.

Unlike standard comparison sites, we have access to specialist providers who understand that HIV is a manageable condition, not a barrier to life insurance.

Whether looking for term life, whole of life, or income protection insurance, we help you find the best coverage at the most competitive rates.

Our team of experts will assess your unique situation, compare policies, and guide you through the application process, ensuring you get the protection you need without unnecessary costs.

Getting life insurance with HIV is more accessible than ever

You can secure life insurance hiv positive coverage at near-standard rates with well-managed health and the right insurer.

If you’re ready to explore your options, contact Chimat Life today. Our experts are here to help you find the right policy confidently and easily.

Questions People Ask Us:

Will My Partner’s HIV Status Affect My Life Insurance?

No, it won’t. Your life insurance application is based solely on your health and medical history. Your partner’s HIV status has no impact on your eligibility or premiums.

I Was Denied Life Insurance Due to My HIV Status. Is That Wrong?

No, it’s not. Fortunately, there are insurers in the UK who offer life insurance to individuals diagnosed with HIV. If you’ve been declined, it’s possible that the provider you approached does not have inclusive policies.

Chimat collaborates with various insurance companies and HIV organisations to advocate for fairer policies.

Since each insurer has different criteria, it’s best to consult an expert who understands this specialist field.

If you have other medical conditions, like cancer, a specialist insurer may be required to find the best coverage.