Are you over 60 and worried about life insurance, especially if health issues could affect your cover? You’re certainly not alone in this concern—many of us face similar challenges.

The good news is that there are many policies available that offer guaranteed acceptance without medical exams, up to age 80.

Benefits Of Buying Cover At This Life Stage

- Premiums can start from under £20 per month. For example, Liverpool Victoria offers £50,000 Term Life coverage at £17.96 per month for non-smokers aged 60 and above. Rates rise with age or smoking habits.

- Choosing policies in your early 60s locks in fixed rates. This can offer you protection from increasing prices as consumer costs climb.

The Chimat team will clearly explain the different types of life insurance for people over 60, including no-medical-exam options.

We’ll help you find the right life insurance over 60 no medical exam policy so you can confidently protect your family’s future.

Over 60 And Searching For An Affordable Life Insurance Policy? Get A Quick Quote Below

What is Life Insurance Over 60?

Life insurance over 60 provides financial protection for our loved ones after you pass away. Policies are specifically tailored for UK residents aged between 50 and 80 years old.

Over 50s Fixed Life Insurance is one popular choice available, without medical checks required.

With rising life expectancy in the UK, many of us now have mortgages, personal loans, or credit cards beyond the age of 60; having a suitable life insurance policy helps cover these debts.

Taking out life insurance isn’t about predicting the future; it’s preparing for it.

| Feature | Description |

|---|---|

| Age Eligibility | 60+ years |

| Medical Check Requirement | Not necessary |

| Payout Type | Fixed lump payment |

| Payment Terms | Monthly: Stopping payments can lead to the loss of cover |

| Policy Type | Often falls under over 50s life insurance category |

Types of Life Insurance for Over 60s

Choosing the right life insurance policy at your age can help protect loved ones and secure our financial future.

We’ll explore different options, from long-term cover to policies that adjust over time, to figure out what’s best for us.

Whole of Life Cover

Whole life insurance plans, such as Over 50s Fixed Life Insurance, give financial security for a family after you’re gone.

- This policy covers you for life and does not expire at a certain age like term insurance would.

- An important feature of this type of whole life cover is that premium payments end when you reach 85-90 years old.

- You continue to have full protection, but stop paying into the plan at that time.

The maximum cash payout our loved ones can receive from an Over 50s Fixed Life Insurance is £10,000, enough to cover funeral costs or ease financial burdens after our death.

For seniors in their sixties looking into over 60’s life insurance without medical exams—this option often proves appealing due to its simplicity and guaranteed acceptance with no health checks required.

Next, let’s look at Level Term Cover and how it compares with Whole of Life policies discussed above.

Level Term Cover

Level term cover offers you a clear and fixed payout. This type of term life insurance gives your loved ones a set amount if you pass away within the policy term.

- Common lengths range from 10 to 30 years, making it easy for you to choose one that aligns with your retirement plans and savings goals.

- For someone in their sixties living in the UK, monthly payments average around £21.41 for coverage between £4,000 and £5,000.

Age, smoking status and how much insurance cover you pick affect your premiums directly.

Good health can help lower costs further, even with plans offering life insurance over 60, no medical exam needed.

Level term life insurance is simple to understand: neither the payout nor the cost changes as time passes or inflation rates rise.

A level term plan brings clarity; you know exactly what your family will receive. – Financial Advice Expert

Decreasing Term Cover

Decreasing term cover helps you protect mortgages or debts, with payouts that reduce over time.

- This type of policy works well if you aim to lower your mortgage balance as you grow older.

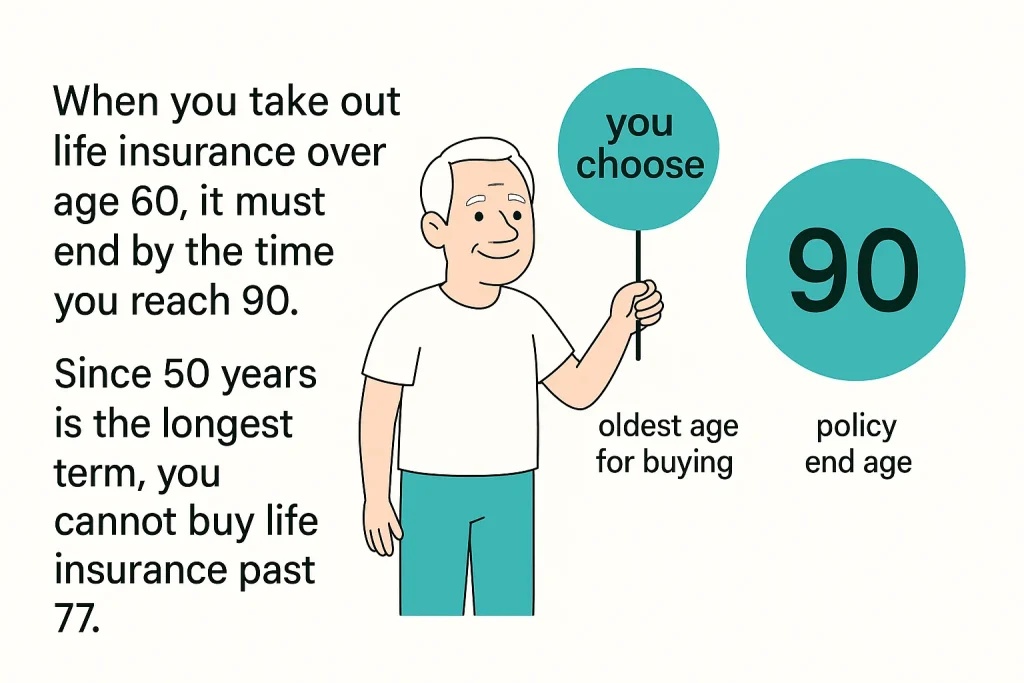

- The amount paid out decreases, matching the drop in what you owe. These policies must end by age 90, but can last up to 50 years.

Age and smoking habits affect how much insurance premiums will cost you. Many insurers offer life insurance for seniors over 60 no medical exam options—helpful if health issues like cancer, stroke or dementia worry you.

Click To Compare QuotesDecreasing term suits your situation best if you’re worried about passing debts on to family members rather than offering long-term financial security or managing inheritance tax liabilities.

Benefits of Life Insurance Over 60

Taking out life cover after turning 60 helps provide peace of mind for our family and finances—read on, there’s plenty more to consider.

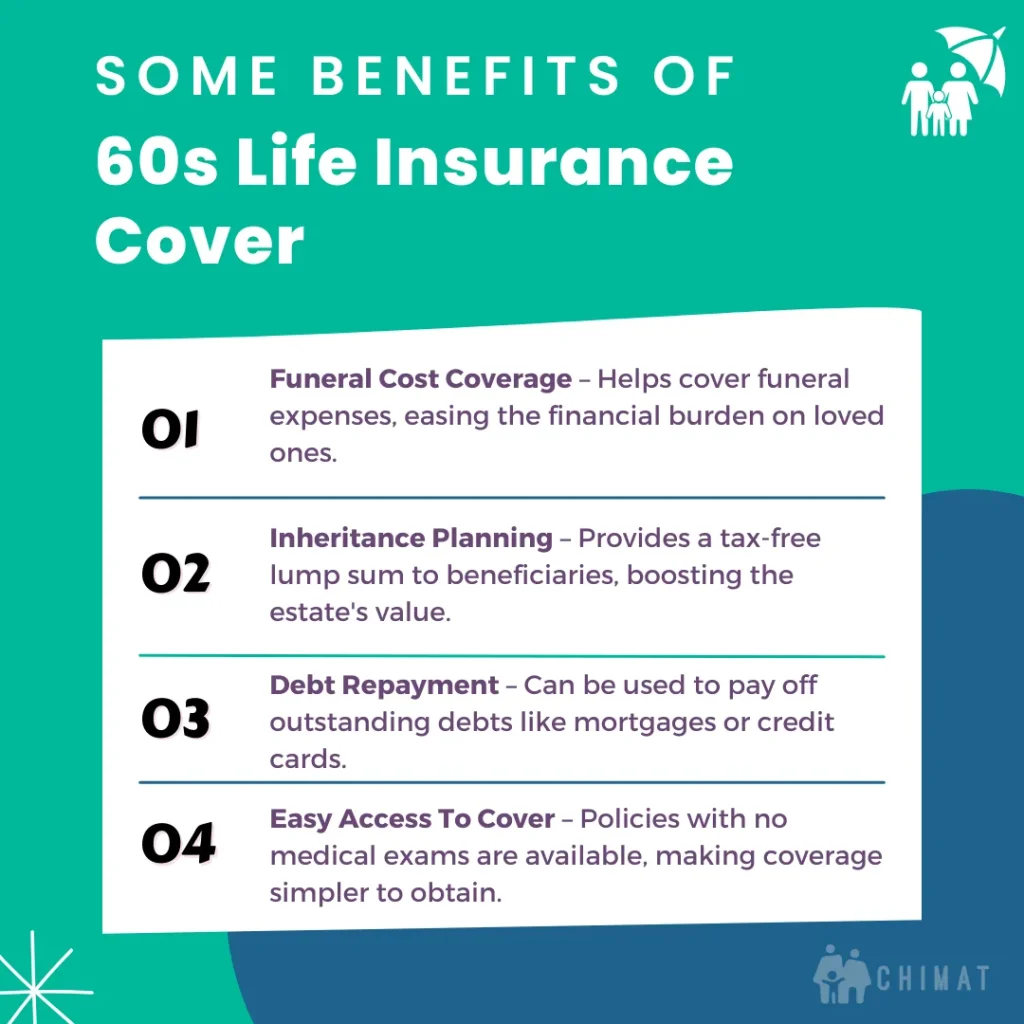

Covering Funeral Costs

Life insurance over 60 years old can greatly ease the burden of funeral costs for our loved ones. Funeral expenses in the UK average around £4,000 or more — a big cost to bear at a difficult time.

Policies such as Over 50s Fixed Life Insurance offer cash sums that help dependents meet these unexpected bills quickly and without fuss.

Many providers process insurance claims within just one day, ensuring peace of mind in tough moments.

Some plans also include extra perks like optional funeral benefits. For example, policyholders could get discounts of up to £250 on Co-op Funeralcare services.

Life assurance means families won’t struggle with sudden financial stress from funeral arrangements while grieving the loss of someone dear.

Planning ahead saves loved ones worry and expense later on.

Providing Financial Security for Loved Ones

In addition to covering funeral costs, having life insurance policies provides your family with financial security.

- Policies like Over 50s Fixed Life Insurance guarantee a payout without medical exams—ideal if you have pre-existing conditions like heart attacks or Alzheimer’s disease.

- In fact, in 2024 alone, £519 million was paid out for over 13,000 families across the UK through these types of life insurance claims.

By setting up trusts or choosing annuities as part of your pension plan, you can provide ongoing support to loved ones after you’ve gone.

Click To Compare QuotesThese options protect family members from financial risks and low-income issues by offering clear paths to invest in their future.

Whether funds help pay childcare fees for grandchildren, buy a campervan for retirement travel ambitions or simply boost savings in stocks and shares ISAs—life cover ensures practical help at crucial times.

Managing Inheritance Tax

Life insurance not only protects loved ones, but it can reduce inheritance tax, too. Estates worth more than £325,000 face a hefty bill of 40 percent in the UK—a big sum for your family to cover.

With careful planning and financial advice from an expert, life policies like ‘whole of life cover’ help manage these tax bills.

We can help set up life insurance payouts as trusts. This ensures the money goes straight to loved ones without delays caused by probate or extra inheritance tax costs.

Specialist guidance helps you choose wisely—some insurers even offer quick and easy quotes with ‘life insurance for over 60 no medical exam’.

How much does life insurance cost for a 60 year old?

Once we’ve looked at the best life insurance plans for your age group, cost becomes a key factor in choosing cover that suits our budgets.

Below, we’ll find average monthly premium costs for life insurance at age 60, depending on various factors such as gender, smoking, health, lifestyle and level of coverage.

| Policy Type | Term Of Cover | Sum Assured | Average Monthly Cost |

|---|---|---|---|

| Decreasing term | 10 years | £55,000 | £17.96 |

| Level term | 10 years | £55,000 | £28.20 |

| Whole of life | Until you die | £50,000 | £91.08 |

| Over 50s plan | Until you die | £5,000 | £27.31 |

Factors to Consider When Choosing a Policy

Before you pick a life insurance plan, you’ll need to think about things like your health status, as some policies offer cover without medical exams.

Costs can vary widely, too, depending on factors such as premiums and the length of the policy term, so it’s good to compare quotes online through our browsers.

Health and Medical Exams

We know health is a big concern in our sixties, but getting life insurance doesn’t have to mean complicated medical tests.

Many insurers offer the best life insurance for seniors over 60, with no medical exam required, such as Over 50s cover, which means faster approvals and less hassle.

Companies may still ask a few questions about lifestyle or past illnesses, such as diabetes, so honesty is always important here.

Smokers do face higher premiums because health risks are bigger; quitting smoking can lower these costs.

Your premiums will reflect your personal situation, including factors such as exercise habits, drinking habits, and any previous critical illness coverage.

Life insurance quotes over 60 no medical exam needed could be great news if you worry about being uninsured due to previous health issues or conditions such as diabetes or high blood pressure.

Policy Length and Premiums

Policy lengths differ by the type you choose. Term policies can last up to 50 years but must end before you turn 90. Whole of Life Cover stays in force for your whole life, with no set end date.

Premiums vary widely based on factors like age, smoking habits and the amount chosen as cover.

To give an idea, a typical policy for people your age might cost under £20 a month for coverage ranging from £45,000 to £55,000.

Over 50s Fixed Life Insurance starts at only around £5 per month—with no medical exam—but careful thought matters because payments could overtake the payout.

So let’s think carefully about these details before moving on to the next topic—What Is The Best Life Insurance For The Over 60s?

What Is The Best Life Insurance For The Over 60s?

For those over 60 in the UK, Legal & General offers Defaqto 5-star rated Over 50s Fixed Life Insurance.

This option gives guaranteed acceptance with no medical questions asked—ideal if you want life insurance for parents over 60, no medical exam needed and quick approval.

However, the best choice varies based on your situation, including health issues such as a heart condition, financial goals like managing inheritance tax or supporting a business, and your ability to pay comfortably each month.

You should research carefully and consult with a member of the Chimat team who can help you compare options.

Options include decreasing term cover if you’re paying off debts, level term cover if you’re providing steady security, increasing term cover to tackle rising funeral costs or inflation, or even an annuity for regular lifetime payments instead of a one-time lump sum payout.

Life insurance over 60 can offer valuable peace of mind

With many options available—from Whole-of-Life to Over-50s Fixed Cover—there’s a policy for every need and budget.

Careful consideration of health, family finances, and funeral costs helps ensure you choose the right cover.

Whether leaving an inheritance, supporting loved ones or covering final expenses, life insurance offers comfort during later years.

Making the decision about what age you should get life insurance is something people still put off for a later date.

However, deciding now means protecting our family’s future security and easing financial worries ahead.

Life Insurance For Other Age Groups

Life Insurance for Those in Their 30s

Your 30s are a great time to secure life insurance, especially if you’re starting a family or buying a home.

Premiums tend to be lower at this age, making it an affordable option for planning ahead. Locking in a policy now can provide peace of mind for your loved ones and future financial stability.

Life Insurance for People in Their 40s

In your 40s, life insurance becomes even more critical as financial responsibilities often increase.

Whether you’re raising children or supporting ageing parents, a policy can protect your family’s future. It’s still a good time to secure coverage with competitive rates and tailored options.

Life Insurance Plans for Young Adults

Obtaining life insurance as a young adult may not seem urgent, but it can be a prudent financial decision.

Young people typically enjoy the lowest premiums, and starting early builds a solid foundation. It’s a proactive way to protect your future and any dependents in the years to come.

Further reading and research sources:

- https://www.britishseniors.co.uk/over-50-life-insurance/helpful-online-resources-for-seniors

- https://www.gov.uk/government/publications/planning-and-preparing-for-later-life/planning-and-preparing-for-later-life

- https://www.royallondon.com/guides-tools/life-insurance-guides/too-old-for-over-50-insurance/