The idea of getting life insurance may deter some people. After all, you don’t want to entertain the idea of leaving your loved ones.

However, Life insurance isn’t a luxury. It’s an essential way to secure your family’s future.

For this reason, all fathers and caregivers should consider purchasing life insurance to help support their families financially, as the cost of living continues to rise.

Life Insurance For Dads provides financial protection for your family in the event of your passing. Finding cheap life insurance for dads can help secure peace of mind without straining your budget.

- ✔ Protects your children’s future with a tax-free lump sum payout

- ✔ Covers mortgage, childcare, education costs and daily living expenses

- ✔ Available for all types of dads – including single, stay-at-home and working fathers

- ✔ Compare policies to find the best life insurance for dads with flexible cover options

- ✔ Get instant life insurance quotes for dads from leading UK insurers

Life insurance for Dads starts at only £6 per month. Compare offers from leading UK insurers today.

Why Dads Should Consider Life Insurance

Fortunately, life insurance policies are incredibly flexible. You can assess your financial commitments and predict your family’s future needs.

Then, you’ll pay a relatively small monthly premium and get lifelong peace of mind.

Fathers, particularly single parents, are the primary providers for their children. Though a life insurance policy won’t make up for the tremendous pain and loss of a dad’s death, it’ll provide much-needed financial protection.

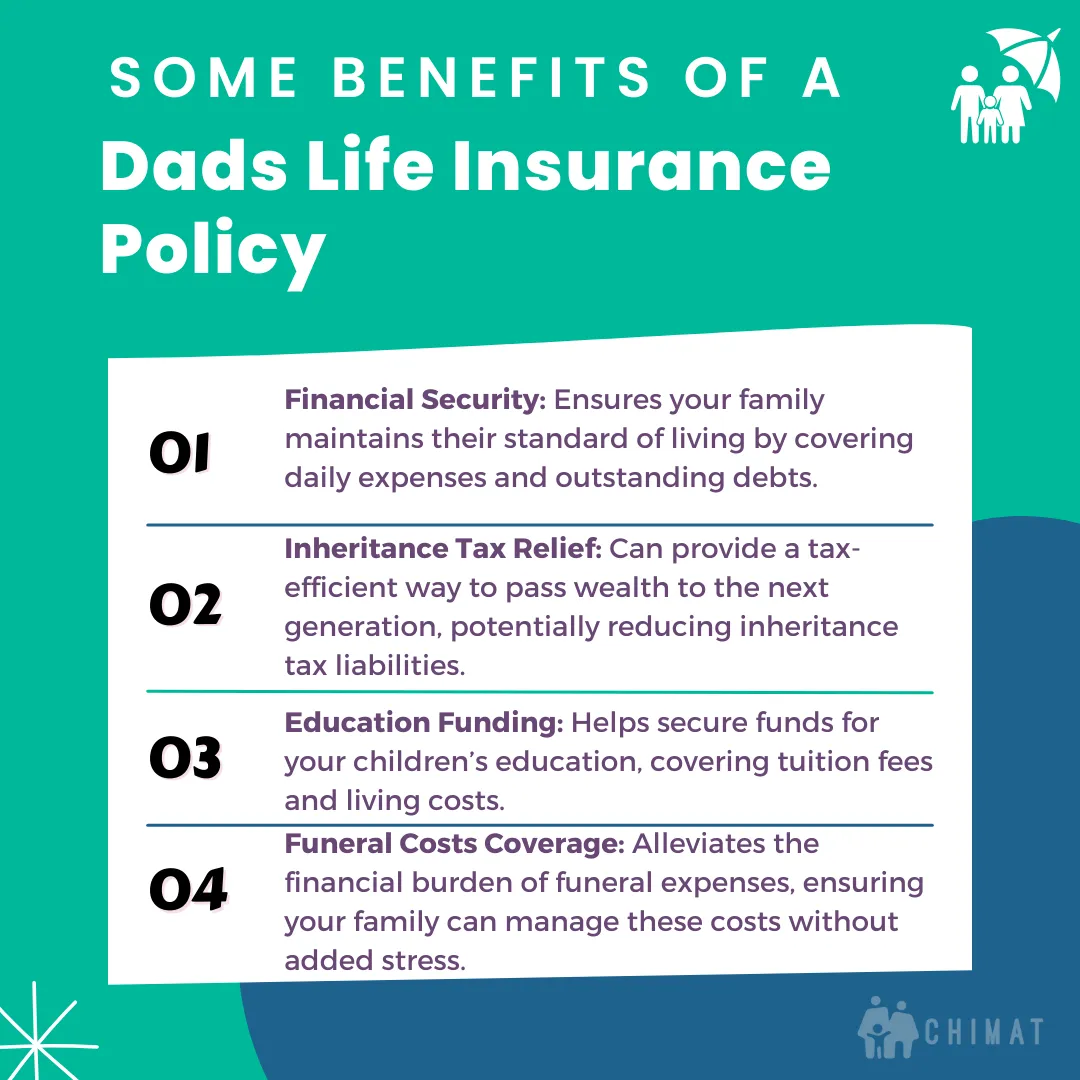

That’s because life insurance for dads can cover the following financial burdens associated with the loss of a fathers:

- Loan repayments

- Family living expenses

- Mortgages

- Funeral costs

- Childcare and education fees

Types of Life Insurance Plans for Dads

Take a look at the different insurance options you can take out at Chimat Life:

Term Life Insurance

As the name suggests, term life insurance policies are determined by the length of the policy, rather than the sum insured.

This insurance type is typically best suited for covering a loan or mortgage. You can also use it to cover other financial obligations, such as your children’s education and lifestyle expenses.

Click To Compare QuotesYou won’t have complete freedom with your policy term, though. That’s because there’s always a minimum and a maximum insurance term, which vary by insurer.

Dad’s talk when you need to, and for your family’s peace of mind

If you’re a dad looking to protect what matters most, our callback service allows you to choose the day and time for us to call you back.

You can expect clear, no-pressure guidance on which cover is appropriate to support children, a mortgage, or parental responsibilities.

Please use the form below to book a call:

There are three types of term life insurance:

Decreasing Term

Decreasing term life insurance is designed to help your loved ones pay off any loans you might’ve taken out. The insurance payout decreases over time, eventually reaching zero.

In this case, the mortgage or loan will have already ended, or you’ll have repaid a significant portion. This is an incredibly affordable term life insurance.

Increasing Term

With increasing term insurance, the insurance payout increases as the policy term extends. This is ideal for families with young children, as the sum insured will cover children’s university fees.

Furthermore, increasing term policies account for inflation. They also mitigate inheritance taxes and hefty funeral expenses.

Level-Term

Level-term life insurance policies are straightforward. Both the lump sum and the term are fixed. Therefore, your dependent will receive the same insurance payout regardless of when they make a claim.

Whole-of-Life Insurance

A whole-of-life policy is a type of permanent life insurance with no expiry date, unlike term life insurance.

This provides exceptional peace of mind, as you’ll be guaranteed the financial security of your loved ones, no matter when you might pass away.

Click To Compare QuotesMoreover, you won’t have to worry about renewing your policy and paying a more expensive premium as you age. Instead, the premium doesn’t change if the policy is valid.

Joint Life Insurance

Joint life insurance for parents is an affordable way to secure their children’s financial future, especially if both parents contribute financially to the household.

There’s no need to get two separate policies and pay two premiums. Life insurance plans for mums are also available at competitive rates, especially if they are in good health.

The policy pays out in the event of one parent dying. If a joint life insurance policy is claimed, the surviving parent will no longer be covered, so they’ll need to take out another policy.

Additional Life Insurance Benefits

Now that you know the basic life insurance policy, it’s essential to understand the additional coverage these policies might include.

These benefits offer exceptional financial support in life-altering circumstances. If you don’t think life insurance is right for you, these plans will change your mind.

Some insurers offer the following benefits for an additional premium, allowing you to tailor the policy to your specific needs.

Alternatively, other policies already include them, so you won’t have to pay any extra fees. They include:

Family Income Benefit

Instead of your family and loved ones getting an insurance payout in the event of your passing, you can choose for them to receive a monthly family income.

This benefit provides a series of smaller, tax-free monthly payouts for your family, comparable to your income. The larger the monthly income, the higher the premium you’ll need to pay.

Many dads opt for this benefit because it simplifies their financial management. Additionally, it’ll be like they never left.

Children’s Cover

Children’s coverage is another insurance term that dads should be aware of. While no one wants to think about their child getting ill, this possibility has numerous emotional and financial burdens.

You can insure one or more children on the same policy by paying an additional premium for each child.

You’ll get financial compensation if your child gets in an accident or suffers one of the following serious injuries:

- Permanent bacterial meningitis

- Irreversible blindness

- Irreversible deafness

- Cancer

- Encephalitis

- Permanent physical severance

- Total paralysis

- Traumatic head injury

Critical Illness Cover

Critical illness coverage is a vital component of all family life insurance policies.

This benefit covers life-changing illnesses that might hinder you from working and providing for your family. It also takes into account the significant medical expenses associated with critical illness.

Click To Compare QuotesSome policies include life insurance and critical illness coverage. However, the policy is invalid if the insured individual doesn’t survive for 30 days after the diagnosis.

Each insurer has its own definition of critical illness. It typically includes:

- Cancer

- Coronary artery by-pass grafts

- Heart attack

- Stroke

- Organ transplant

Terminal Illness Cover

While critical illness doesn’t payout if the insured person dies within a month, terminal illness is the exact opposite.

This policy covers conditions that may prove fatal after a specified period. The payout can be used to cover hospice care, medical expenses, and funeral fees.

Some life insurance policies include terminal illness cover, while others include only critical illness cover.

How to Select the Best Life Insurance Plan

Choosing the best life insurance option depends on your needs and worries. After all, life insurance is meant to alleviate any stress you might have about the future and provide financial protection.

Here’s everything you should keep in mind when getting a life insurance quote and comparing your options:

Age of Your Children

The first thing you must consider is your children’s age. The younger your children are, the more you’ll need to get insurance.

While your children depend financially on you, decreasing or level-term policies are ideal. These are the cheapest options.

So, you won’t need to compromise on your children’s quality of life to secure their future.

In contrast, many fathers also take out life insurance to provide for their families.

In this case, a universal life insurance plan is the most cost-efficient option because premiums are low and payouts are variable.

Loan Term

The insurance and loan terms should be identical if you’re taking out insurance to cover a loan or a mortgage. Additionally, the sum insured should match the repayments.

For this reason, many experts recommend decreasing term insurance policies if you’ve got a mortgage.

While payouts decrease over time, they consistently match the amount of debt the insured person still has.

Insurance Payout

Lastly, you must carefully consider the insurance payout, especially if the policy is meant to support your family.

You don’t want to pay low premiums only to find that the sum insured is insufficient to support your family.

Alternatively, you’ll get rejected if you apply for insurance disproportionate to your income.

The best thing to do is to estimate where the payout is going. Increasing term insurance is the way to go if you want to pay for your children’s college.

On the other hand, whole-of-life insurance is ideal if providing a good quality of life for your children is the main priority.

This can be incredibly hard to determine on your own. Many insurance companies say a reasonable life insurance coverage should be ten times your annual salary.

Still, how can you ensure this figure is sufficient for your family?

Luckily, we’ve got you covered. Our insurance quote calculator is a free, obligation-free tool that helps you compare the UK’s leading insurers.

Life Insurance for Employees vs. Self-Employed Dads

Your employment status can affect your insurance policy in the following ways:

Employees

If you’re an employee, you probably already have an insurance plan through your workplace. The standard policy typically includes a death-in-service benefit.

Your family will receive a cash sum in the event of your demise during the time of your work. Yet, this doesn’t have to be a work-related death.

You should consider this if you’re applying for a new policy. The reason is that insurers might reject you if the sum coverage of the two policies is significantly high.

You can still opt for a more affordable policy to supplement your existing one.

Self-Employed Workers

Life insurance is crucial for self-employed workers. Not only do they lack a fixed income, but they also do not have the same benefits as employed fathers, such as healthcare and life insurance.

If a self-employed father passes away, there will be dire financial consequences for the family.

Purchasing an insurance policy, regardless of the payout, will make a significant difference.

You should also consider self-employed income protection policies. If you’re no longer earning a consistent income, this policy will provide a tax-free replacement salary until you’re back on your feet.

Factors Affecting Your Dad’s Life Insurance

Insurance companies also have requirements for insured individuals. The insurer aims to reduce the likelihood of payouts by insuring only individuals with low-risk profiles.

After all, if there’s a high chance of an insured individual passing away during the insurance term, the insurance company will need higher premiums to cover the payout.

Accordingly, here are all the factors that’ll affect your insurance conditions, premium, and life insurance coverage:

Pre-Existing Health Conditions

Some health conditions can significantly increase your premium or disqualify you from obtaining certain policies.

These include the following:

- High BMI

- Diabetes

- Chronic heart disease

- Cancer

- Mental disorders

When applying for insurance, you must give a detailed medical history. You’ll also be required to provide a family medical history.

Then, a group of underwriters will establish your premium based on your health condition.

When filling out your medical history, it is crucial to be as honest and detailed as possible. Omitting information might reduce your premium.

However, you’ll probably need to take medical exams. If the insurer learns about your accurate history, they’ll immediately disqualify you.

Age

Your age significantly impacts your premium, as well as the insurance term and coverage level.

For starters, older age means you’re closer to your life expectancy. In turn, you pose a higher risk to insure.

Typically, premiums rise by about 8 to 10% for every year of age. You’ll pay extra even if you purchase the same policy with the same term. That’s why it’s best to consider getting life insurance when younger.

Occupation and Lifestyle

Occupation and lifestyle are other risk factors that insurance companies must assess. Blue-collar jobs that require heavy physical labour and involve operating heavy machinery are often quite dangerous.

Accordingly, not only is it crucial for people in these positions to have insurance, but they’ll also need to pay higher premiums because the likelihood of a payout is higher.

Risky lifestyle choices, such as smoking or vaping electronic devices and other reckless activities, make you a less desirable insurance candidate.

Therefore, you may need to pay a slightly higher premium for coverage.

Disability

If you’re a disabled dad, you can still get life insurance. Many providers consider individual circumstances and offer policies for people with disabilities, often at standard rates.

Your disability doesn’t automatically disqualify you; the insurer may ask for more information to assess your application.

Tips for Dads Getting Life Insurance

You might find yourself jumping through numerous hoops when navigating the complex financial elements of life insurance. There’s no need to worry, though.

Here are some excellent ways to secure the best deal without compromising your children’s future:

- Start Early: The earlier you apply for life insurance, the easier the process will be. Additionally, you’ll secure a lower premium, posing less of a risk to the insurer.

- Change Your Lifestyle: Adopting a healthier lifestyle will reduce your monthly premium. Most importantly, though, it’ll ensure you live a longer, happier life while providing for and caring for your children.

- Reassess Your Term Length: Longer insurance terms result in more frequent premium payments. If you choose a 35-year insurance plan, your child will already have started their own family and have their own insurance. Therefore, opting for the shortest-term length is generally preferable.

- Consider Your Family’s Needs: Many believe they’re securing their family’s future by opting for a large insurance policy. However, this means you’ll be paying significantly higher premiums. In contrast, assessing your family’s financial requirements will allow you to pay a lower premium, leaving the rest of your paycheck for your family’s needs.

- Get Professional Help: While only you know your family’s situation and needs best, professionals can help you understand insurance requirements and terms and match you with the best insurance plan. What are you waiting for? Get your quote by reaching out to us now.