Finding the right life insurance policy can feel tricky if you’re a disabled adult in the UK. Around 16 million people in the UK live with disabilities, yet many of them don’t realise they can still get affordable and suitable cover.

The Chimat team will explain how disability affects your life insurance choices and provide useful tips to help you choose the best option for yourself or your loved ones.

Essential Points To Consider:

- Life insurance for disabled adults in the UK is affordable and available. It protects family finances if you pass away. Cover includes lump sums or regular payments to handle debts like average mortgages and funerals.

- Many wrongly believe life insurance is too costly or limited if you’re disabled, but suitable, budget-friendly policies exist with tailored options to cover unique financial needs.

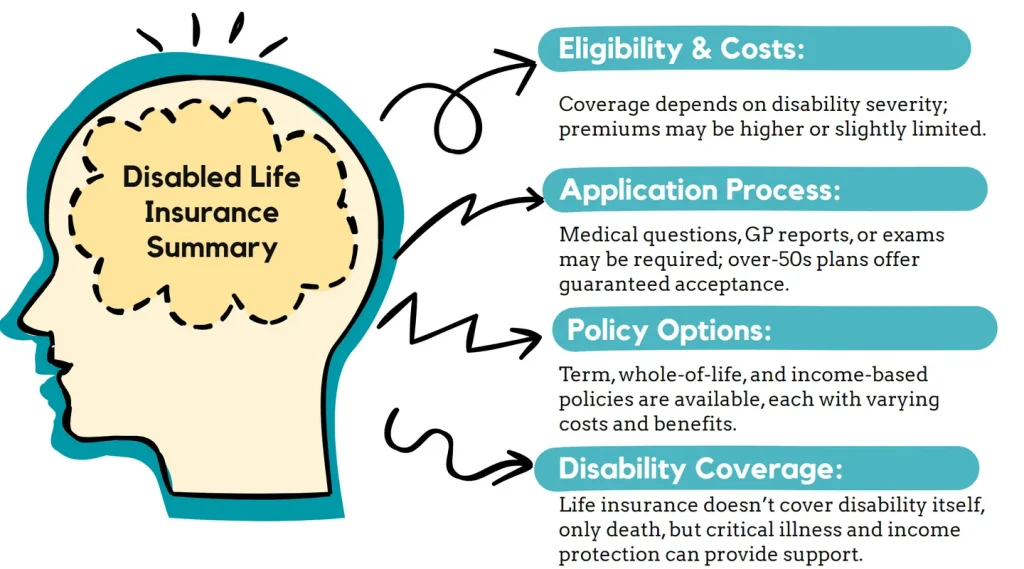

- Disability type and severity can affect premium costs; insurers assess health carefully. Policies without medical exams, like over-50 plans, are also available for quick acceptance despite pre-existing conditions.

- Chimat Life helps disabled adults compare quotes fairly according to UK law against unfair treatment due to disability or related health problems.

Compare Plans From Leading UK Life Insurance Providers Today.

What is Life Insurance for Disabled Adults?

Life insurance for disabled adults is an affordable type of policy designed to protect loved ones if the insured passes away.

Disabled people in the UK can access these life insurance policies, just like anyone else, with coverage depending on disability type and daily impact.

Premiums depend on factors such as health status, pre-existing medical conditions or severity of any mental health problems like depression or anxiety.

Life insurers typically ask about your condition during medical underwriting—this helps them determine risk levels and suitable prices.

Policies provide a lump sum after death or smaller, regular payments over time to cover things such as mortgages, childcare bills or living costs.

Why Might Disabled Adults Need Life Insurance?

Life insurance gives disabled adults peace of mind about money. It helps ease worries around finances for family, debts or long-term care costs.

Financial security for loved ones

Having a disability means that sorting financial matters early is crucial. Life insurance for disabled adults can protect your family members from money worries if the worst happens.

In Britain, the average household mortgage debt is around £137,934. Without you around to pay, loved ones may struggle with such debts or personal loans.

Add to this costs like funeral expenses, which average £ 3,953 and often rise to an overall cost of dying about £9,200, and it becomes clear that coverage makes sense.

Click To Compare QuotesTerm life or whole life insurance can ensure that children and partners have the funds they need during tough times.

Such policies bring peace by providing cash payments so your family avoids serious debt or losing their home if mortgage repayments become too stressful after you’re gone.

Covering outstanding debts

Life insurance is important for disabled adults to cover outstanding debts, such as personal loans, credit cards, or car finance.

In the UK, the average personal debt (excluding mortgages) is £34,566; without proper cover, these costs could become a burden on loved ones.

A term life insurance policy can ease financial pressure by settling things you owe after you’re gone—or prevent big bills from causing stress as the cost of living rises and inflation bites harder.

This ensures that close family members have security and stability rather than worrying about unpaid bills.

Supporting long-term care costs

Long-term care for disabled adults is often costly in the UK—but life insurance can ease this pressure.

For example, full-time childcare for children under two costs about £302.10 weekly, while part-time childcare costs around £7,000 each year.

A good whole life policy or permanent life insurance could help families cover these high expenses.

Disability should not stop anyone from getting fair access to coverage; rules from the Financial Conduct Authority protect against disability discrimination by insurers.

Working with experienced financial advisors like Chimat Life could help you find affordable premiums that fit your budget and support long-term care needs in later years, beyond state pension and personal independence payment funds alone.

Interactive Life Insurance Tool For Disabled Individuals

Types of Life Insurance for Disabled Adults

There are various life cover options in the UK, each with different benefits for disabled adults.

Level Term Life Insurance

Level Term Life Insurance gives you cover for a fixed number of years, such as 10, 20 or even 30. This insurance policy pays out a set lump sum if the policyholder passes away within that time frame.

The payout stays the same, so £200,000 coverage today means £200,000 in ten years as well. You could use this money to pay off your mortgage or other debts like car loans and credit cards.

Many people with disabilities choose it because its premiums are lower than those of whole life cover, making it more affordable.

Some insurance companies let disabled adults buy Level Term policies without a medical exam, but they’ll still ask health questions about issues like psychosis or vision problems.

Disability alone doesn’t exclude someone from level term cover—the insurer looks carefully at each case before setting the premium price.

Chimat Life can help adults living with disabilities assess provider options and find fair quotes for their personal needs—it saves the hassle of dealing directly with different insurers yourself.

Whole Life Insurance

Whole life insurance provides lifetime coverage with a guaranteed payout to your loved ones. Unlike level term or decreasing term life insurance, it does not expire after a set period. So, as long as you pay your insurance premiums, the policy remains active until death occurs.

Click To Compare QuotesPremiums are typically higher than other options like family income benefit, but whole life assurance can build cash value over time which could support retirement planning or estate planning goals.

Chimat Life, an experienced insurance agent, can find affordable coverage for disabled adults even if they have pre-existing medical conditions or mental health conditions such as schizophrenia.

Whole-life policies help ensure financial stability for carers and family members after you’re gone, protecting them from debts and covering homebuying costs like stamp duty on buy-to-let properties, ensuring peace of mind during uncertain times.

Decreasing Term Life Insurance

Decreasing term life insurance is a type of cover offered by many insurance companies in the UK. The sum paid out gets smaller yearly, matching financial commitments that reduce over time—like your mortgage or any important loans.

For example, if you have a loan on a buy-to-let home worth £200,000 for twenty years, this policy pays less each year as your debt shrinks.

This kind of protection can cost less than level term policies because the payout decreases throughout its length.

It helps ensure outstanding debts won’t burden loved ones if you’re no longer around to pay them yourself or if terminal illness strikes earlier than your predicted life expectancy might suggest.

Always consult trusted insurance brokers or agents like Chimat Life before choosing this cover. This will help you understand premiums clearly and avoid discriminatory practices relating to disability and pre-existing conditions.

Family Income Benefit

Family Income Benefit is a type of life insurance popular with many families in the UK. If you pass away during the insurance term, it provides your loved ones with regular, tax-free monthly payouts, usually up to £10,000 each month.

These payments help families maintain their standard of living and manage daily expenses like car insurance premiums, pensions or repayments on debts that might otherwise lead to assets being repossessed.

Monthly payments from the Family Income Benefit can ease financial worries if an earner has a disability or mental impairment.

Instead of receiving one large lump sum payment from an insurance company—like other policies provide—your family receives steady financial support directly into their bank account.

This approach helps cover essential costs such as mortgage payments or even sick pay replacement without adding interest charges or extra stress for those relying on universal credit or national insurance assistance.

What’s the best life insurance for disabled seniors in the UK?

The best life insurance for disabled seniors depends on your health, age, and financial requirements.

Life insurance for people over 50 remains a popular option. It offers guaranteed acceptance with no medical checks.

Providers such as SunLife, Aviva, and Legal & General all offer fixed monthly premiums and lump-sum payouts.

If you are in better health, whole-of-life or term life insurance can provide higher payouts. It is worth mentioning that some insurers offer funeral plans as an alternative.

How Disabilities Impact Life Insurance Policies

A disability can affect how insurance carriers set premiums and policy terms, and medical assessments can play a significant role. Pre-existing conditions and level of disability often decide the price and choice of life insurance you get offered.

The role of medical examinations

Medical examinations help insurance agents and the insurance provider assess your health carefully. These tests check height, weight, and blood pressure; sometimes, blood or urine samples are needed to underwrite your policy.

Click To Compare QuotesSome insurers offer over-50s plans for adults aged 50–85 in the UK; these policies don’t require medical exams or disclosure of pre-existing conditions.

Life insurance for disabled adults may also not always involve a medical exam. Some group insurance schemes from employers skip this step entirely.

The severity of a disability and premiums

Severe disabilities often lead to higher life insurance premiums. Providers in the UK check how much a disability affects your lifespan when they decide policy costs. For instance, Parkinson’s disease could mean paying more compared to less severe issues.

Insurers cannot reject someone just because of their disability—that is against the Equality Act 2010 rules, which apply here.

However, the type and seriousness of your condition can affect prices and the policies insurers can offer you under life insurance for disabled adults in the UK.

It’s worth speaking openly about your health situation during the application to avoid issues related to pre-existing conditions or claims that may be considered insurance fraud later on.

Pre-existing medical conditions

Pre-existing medical conditions affect getting life insurance for disabled adults in the UK. Insurance companies need to know about your health issues at the start of your application.

These details help insurers decide if they can provide coverage and work out how much it will cost, such as higher premiums or special terms.

British law protects against unfair treatment based on disability insurance needs and pre-existing conditions.

You must always be open about past illnesses or treatments when applying.

For example:

| Disability Category | Examples |

|---|---|

| Neurological Disorders | Multiple sclerosis, epilepsy |

| Cognitive Impairments | Dementia, intellectual disabilities |

| Hearing Impairments | Deafness, severe hearing loss |

| Visual Impairments | Blindness, severe vision loss |

| Musculoskeletal Conditions | Arthritis, cerebral palsy |

| Mental Health Conditions | Severe depression, schizophrenia |

| Respiratory Disorders | Cystic fibrosis, severe asthma |

| Cardiovascular Conditions | Congenital heart disease and the effects of stroke |

| Mobility Impairments | Paraplegia, quadriplegia |

| Chronic Illnesses | Diabetes with complications, kidney disease |

If you hide these facts, insurers may refuse claims later on, causing stress for loved ones you want covered by your policy.

Tips for Finding the Right Life Insurance Policy

Finding the right life insurance policy can be simple. Explore your options, use online calculators to estimate coverage and premiums, and then speak with a trusted advisor from Chimat Life to guide you further.

Assess the coverage you need

Life insurance for disabled adults in the UK needs careful thought. Consider your family’s financial obligations, like mortgages, outstanding debts and childcare costs. Choose a plan that fully covers these needs.

Long-term care expenses can rise quickly; include enough protection to support carers or special treatments if needed.

Compare quotes from multiple providers

Comparing quotes from different providers can help you find good cover at lower rates. Providers like Chimat offer fee-free quotes from FCA-regulated companies, making your search safe and easy.

We give free, unbiased life insurance advice that is useful for disabled adults or those with pre-existing conditions looking at policies in the UK.

Checking prices side by side clearly shows you who offers better value based on your budget and needs.

Consider policies without medical exams

Policies without medical exams are a good choice for disabled adults, especially those with pre-existing conditions. Over-50s plans in the UK do not ask you to have health checks or blood tests, making approval quick and easy.

Providers like Chimat Life can offer clear advice about life insurance for disabled adults, helping you find affordable coverage that meets your needs.

These no-exam policies remove the stress linked to detailed health screenings often required by traditional insurers.

Such plans give disabled adults confidence when planning financial security and providing support for loved ones after they’re gone.

Work with an experienced insurance advisor like Chimat Life

Chimat Life is a helpful partner for finding life insurance for disabled adults in the UK. We can guide you through different policy types, like whole life or level term cover.

Chimat offer services to find suitable plans, even if you have pre-existing conditions linked to your disability. We specialise further by having an impaired risk team that supports those with greater health challenges.

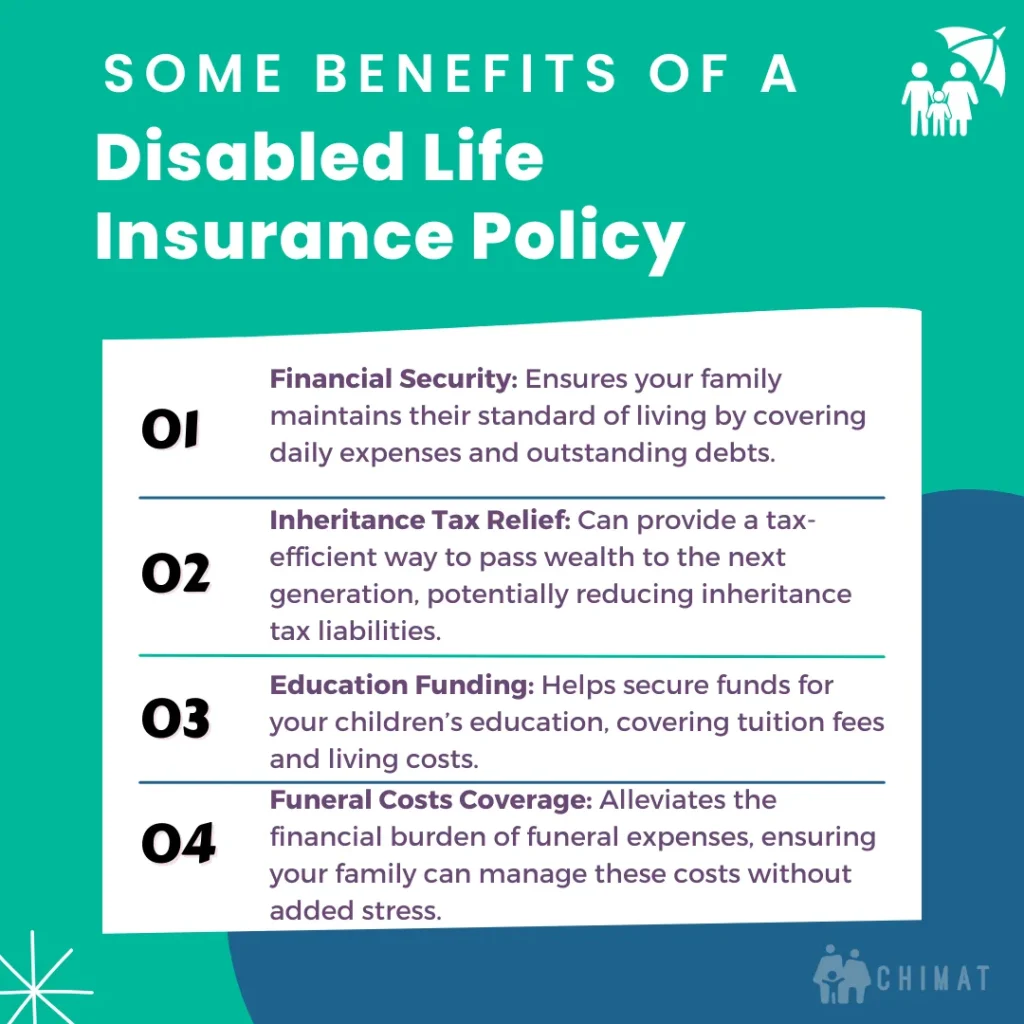

Benefits of Life Insurance for Disabled Adults

Life insurance gives your family peace of mind, easing stress during life’s tougher moments. Policies can match your exact situation, fitting neatly around the unique needs you have each day.

Peace of mind for families

Having life insurance for disabled adults in the UK gives families peace of mind. Family members know they’ll have financial security if a loved one passes away. Like partners or children, dependents get vital support to keep paying bills and meet daily costs.

With suitable cover, even with pre-existing conditions, families won’t struggle with debts or sudden care expenses.

Financial stability during uncertain times

Life insurance provides crucial financial support during uncertain periods. For adults with disabilities, living costs are often higher—around £975 extra each month.

A suitable policy protects your family from these added expenses, covers outstanding debts and manages everyday living costs—even if you have pre-existing conditions.

A secure life cover plan means certainty for families facing life’s surprises. Sudden illness or economic changes can hit hard—but a reliable insurance policy keeps money issues under control and reduces stress for everyone concerned.

Tailored policies for specific needs

Insurance providers offer policies made for your specific financial needs. They include extra options like critical illness cover or income protection insurance, useful if you have a disability or pre-existing conditions.

From personal experience in the UK, I’ve seen disabled adults choose level term life to keep loved ones secure, family income benefit plans for regular monthly support, and whole life cover as long-term savings.

Specialised insurers such as Chimat Life also help clients who want plans without medical checks, which is ideal if health exams are difficult due to their condition.

These personalised choices provide exactly what’s needed without unnecessary add-ons or unwanted premiums.

Common Misconceptions About Life Insurance for Disabled Adults

Many people wrongly assume life insurance costs too much or has strict limits for disabled adults—find out the facts below.

Life insurance is unaffordable for disabled individuals

Life insurance can be affordable and accessible for disabled people. Providers in the UK offer policies to suit different budgets, even with pre-existing conditions.

Premiums may vary due to disability severity or health factors, but comparing quotes often reveals manageable options.

Disability alone doesn’t mean costly life cover. By assessing your needs clearly and working with experienced advisors like Chimat Life, you can find suitable plans without overspending.

Policies that don’t require medical exams are also available and are sometimes cheaper, making life insurance possible regardless of your condition or budget.

Coverage is limited for people with disabilities

Insurance providers in the UK may limit cover for people with disabilities, especially if they have pre-existing conditions. Providers often link premiums and coverage levels to health status.

Some disabled adults might face higher costs or fewer choices than others, depending on their condition.

Over-50s plans are one way around this issue, as these policies offer acceptance without medical exams. However, they might come with lower payouts or longer waiting periods before full benefits start paying out.

Comparing different insurers can help find policies that suit a person’s specific needs and budget.

Life insurance for disabled FAQs

Do you have questions about cover and pre-existing conditions—or special cases like veterans and parents with disabilities?

Should disabled parents get life insurance?

Disabled parents should strongly consider getting life insurance, as it gives crucial financial safety to their families. A life insurance policy ensures your children have the money they need if you pass away.

It helps pay debts and daily expenses and supports long-term care costs if needed—especially useful when pre-existing conditions exist.

Disabled parents in Britain can choose from Level Term or Whole Life Insurance that fits their family budget and needs—protecting loved ones from sudden financial stress later on.

I’m a disabled veteran; should I get cover?

As a veteran with a disability, life cover can keep your family safe financially. Policies created for veterans take into account pre-existing conditions and particular health needs.

Broker services, like Chimat Life, can find policies that closely match your situation.

Life insurance offers stability if you have debts or ongoing care costs. Specialised insurance advisors understand military injuries and how they impact policy prices.

They will compare options and suggest suitable plans without medical exams if needed.

Life insurance brings peace of mind to disabled adults and their families.

With the right policy, you can protect your loved ones from debts, care costs, and daily living expenses.

Honest answers and expert advice help secure cover, even if insurers turned you down before.

Whether it’s whole life cover or an over-50s plan without medical checks, you can find affordable protection that meets your needs. Life insurance gives financial security to disabled adults in uncertain times.