Finding the right life insurance for firefighters might seem daunting. Their job is seen as high-risk.

The Chimat team will look at how they can get covered often with surprisingly affordable premiums.

Many UK life insurers lack a complete understanding of occupation-related risks. Through extensive research on life insurance for high-risk jobs in the UK, Chimat has identified major insurers providing excellent coverage, often with premiums only slightly above those for tradespeople and machine operatives.

Hazardous occupations such as firefighting may increase life insurance premiums by as little as 12% compared to lower-risk jobs.

Options like critical illness coverage and income protection are also available. In certain professions, factors such as industry experience and personal circumstances are key.

Use our secured online form to get life insurance quotes from specialist providers for high-risk jobs—some insurers may not even classify your role as dangerous.

Need Higher Risk Life Cover? Compare The Best Life Insurance For Firefighters Policies. No Obligation To Proceed

Accessibility and acceptance for high-risk occupations

Getting life insurance can be harder for those in high-risk jobs like firefighters. Some insurers might not want to offer policies because the risks are higher.

Yet, particular companies focus on providing cover for such risky occupations.

They understand the nature of the work and offer life assurance suited to these needs.

Before offering a policy, these companies consider many things, including how often someone is exposed to danger and their overall health.

If a firefighter is looking for coverage, they can find it with these specialist insurers.

It sometimes might cost more than usual policies, but they’re protected while doing their brave work.

Factors determining eligibility (health, age, smoking status)

Getting life insurance is key for firefighters, given their risky job. Insurers look at health, age, and whether you smoke.

- Health: Insurance companies need your medical history. They check if you have conditions that could shorten your life. High blood pressure and heart disease are big concerns.

- Age: Younger applicants often get better deals on life insurance policies. As you get older, premiums may increase because insurers’ risk increases.

- Smoking status: Smokers pay more for life insurance than non-smokers do. This is because smoking can lead to serious health issues like cancer and heart problems.

These factors help insurance companies decide if they will offer you a policy and how much it will cost.

Importance of Personal Life Insurance for Firefighters

Having personal life insurance is key for firefighters. It adds to their death in service benefit and gives money safety to their families.

Supplement to ‘death in service’ benefit

Many firefighters in the UK get a death-in-service benefit. This pays out 3 to 5 times their yearly wage if they die while working. But this is not enough on its own.

Life insurance can pay for significant needs, like funeral costs, and leave some money behind. It ensures that loved ones have fewer worries about money during hard times.

Click To Compare QuotesFor firemen, having death-in-service benefits and personal life insurance offers better protection and peace of mind.

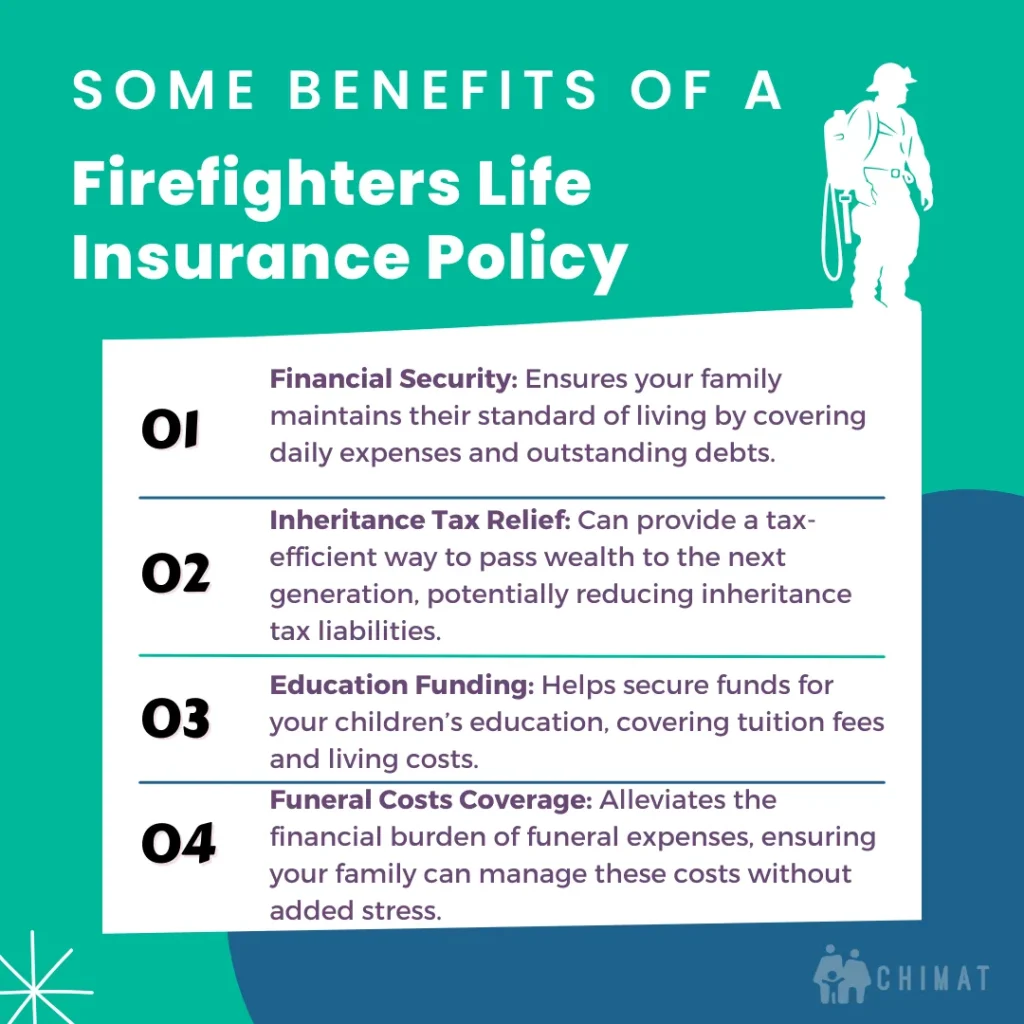

Financial security for loved ones

Life insurance is a safety net for your family. If something unexpected happens to you, it can help support them financially.

It ensures your loved ones won’t have to worry about money during tough times.

They could receive a lump sum or regular payments to cover living costs, debts like a mortgage, or the cost of your children’s education.

Having life insurance is key for firefighters who do dangerous work every day. It means that even if the worst should happen while they’re on duty, their families are protected financially.

This peace of mind lets firefighters focus on their essential jobs without stressing over how their families will manage without their income.

Compare Fire Service Life Insurance Policies. No Obligation To Proceed

Risk Factors and Criteria Considered by Insurers

Insurance companies assess many risks when covering firefighters, and the dangerous nature of their job plays a big role in this process.

Factors like working at heights and handling heavy machinery can raise the cost of premiums.

Insurers also consider health issues linked to firefighting, such as smoke inhalation and heart problems. These elements help determine if a firefighter qualifies for coverage and what they will pay.

The hazardous nature of firefighting

Firefighting is a dangerous job. Firefighters face risks similar to those in hazardous hobbies. They deal with extreme heat, smoke inhalation, and toxic fumes.

These hazards can lead to serious health issues like asthma or even certain cancers.

The nature of the work often requires using dangerous machinery and operating in high-risk environments.

The dangers extend beyond just fighting fires. Firefighters may also encounter difficult situations while rescuing people from heights or during accidents.

Each call brings new challenges that can put their lives at risk.

Click To Compare QuotesUnderstanding these factors helps insurers assess life insurance policies for firefighters more accurately, ensuring they receive proper coverage for their unique needs.

High-risk criteria (work at heights, driving mileage, hazardous environments, handling dangerous materials, heavy machinery operation)

Firefighters face many dangers in their work. These risks affect the life insurance available to them.

Here are the high-risk criteria that insurers consider:

- Work at Heights: Firefighters often work at heights of 12 metres or more. This can lead to serious injuries if accidents happen.

- Driving Mileage: They have high mileage while responding to emergencies. Driving under pressure increases the risk of accidents on the road.

- Hazardous Environments: Many firefighting tasks occur in dangerous settings, like burning buildings or areas filled with smoke and toxic fumes. Exposure to these hazards raises health risks.

- Handling Dangerous Materials: Firefighters may handle explosives or chemicals during rescue operations. Safety is critical as mistakes can have fatal consequences.

- Operating Heavy Machinery: Heavy machinery, such as fire engines and ladders, is commonly used in firefighting. The operation requires skill but carries a risk of accidents.

These factors contribute to how life insurance policies for firefighters are structured and priced, affecting overall financial protection for their families in case of tragedy.

Financial Considerations for Life Insurance Coverage

Firefighters need to think about the costs of life insurance. They should cover any remaining mortgage debt and ensure their families will be financially secure.

Average costs and financial obligations

Life insurance can be a vital part of financial planning for firefighters. The average cost of life insurance varies, but it is essential to consider all your financial commitments.

Many families in the UK face significant debt. For instance, the average mortgage debt stands at £142,754. Also, raising a child until age 18 costs around £157,561.

Monthly premiums depend on various factors, including health and age. Firefighters may pay higher rates due to occupational hazards. Considering these expenses when evaluating critical illness coverage or income protection plans is crucial.

Understanding potential costs will help ensure that loved ones are financially secure if something happens unexpectedly.

Importance of covering remaining mortgage debt

The remaining mortgage debt can be a heavy burden. Firefighters need to think about their families’ future.

Life insurance can help cover this debt if something unexpected happens, ensuring loved ones are not financially stressed.

Click To Compare QuotesBeing in the fire brigade comes with risks. It is smart to have a life insurance policy that addresses these concerns. Protecting against unpaid mortgages gives those left behind peace of mind and security.

A solid plan supports families during tough times, ensuring they keep their home even after a loss.

Health Risks and Conditions Associated with Firefighting

Firefighters face serious health risks. They often breathe in harmful toxins from fires, which can lead to severe illnesses like certain cancers and heart problems.

Increased health risks from exposure to fire toxins

Firefighters face serious health risks from exposure to fire toxins. These harmful substances can enter the body through breathing or skin contact.

Studies show that firefighters have a higher chance of developing certain cancers, heart attacks, and strokes.

The nature of their job puts them at risk in ways many people may not consider.

Regular exposure to smoke and chemicals increases these threats over time. Protecting against these dangers is vital for firefighters and their families.

Personal life insurance can help secure the financial future of loved ones if health issues arise due to this hazardous work.

Knowing they are covered amidst increased health risks associated with firefighting duties provides peace of mind.

Correlation with conditions such as certain cancers, heart attack, and stroke

Firefighters face high risks due to exposure to fire toxins. This exposure is linked to serious health issues, including some cancers, heart attacks, and strokes.

Studies show that firefighting can increase these conditions rates among professionals.

The hazardous work environment often involves handling dangerous materials and working in extreme heat, which can damage firefighters’ bodies over time. Fire service life insurance is crucial for firefighters.

It helps provide financial security for their families should they face any critical health challenges.

Without proper coverage, loved ones may struggle with the cost of living or mortgage debt if an unexpected tragedy occurs.

Types of Life Insurance Suitable for Firefighters & Volunteer Firefighters

Firefighters and those in a voluntary role can choose from various types of life insurance. These options include term life insurance and whole life insurance, each with its benefits for their unique needs.

Decreasing Term Life Insurance

Decreasing term life insurance is a type of policy in which the payout is reduced over time. It helps cover specific debts, like a mortgage, and for firefighters, it offers peace of mind at an affordable rate.

Click To Compare QuotesThe sum assured can be up to £1,000,000. Premiums remain fixed each month, making financial planning more accessible for families. Firefighters should consider this option to ensure their loved ones are secure financially.

Moving forward, it’s essential to understand the different types of life insurance suitable for firefighters.

Level Term Life Insurance

Level Term Life Insurance is a suitable option for firefighters. This policy offers fixed monthly premiums and a consistent payout throughout the policy’s lifetime.

Firefighters can secure coverage up to £1,000,000.

This insurance acts as an important supplement to any ‘death in service’ benefit they may have from their employer.

It ensures that loved ones receive financial security if something happens to them while working in this high-risk job.

Many insurers consider factors like age, health, and smoking status when underwriting these policies, allowing access even for those with pre-existing medical conditions.

The whole of Life Insurance

Whole Life Insurance offers lifelong coverage. It provides a fixed sum assured for life, up to £1,000,000.

The policy lasts for the insured’s lifetime, ensuring your loved ones are financially secure after your passing.

Firefighters may find this insurance beneficial. The hazardous nature of firefighting makes long-term planning essential.

Whole of Life Insurance is a robust financial tool to cover costs like mortgages and supporting family members.

This type of policy can also be tax-efficient, which is crucial in planning your estate and managing inheritance tax obligations effectively.

Over 50s Life Insurance

Over 50s Life Insurance is a good option for older adults. This type of policy offers guaranteed acceptance for ages 50 to 85. The fixed sum assured typically reaches up to £20,000.

There is often a waiting period of 12 or 24 months for claims related to natural causes.

This insurance helps secure peace of mind for policyholders and their loved ones. It can be an affordable way to ensure financial support in the future.

People can use it as part of their overall tax planning and financial conduct authority guidelines in the UK.

Additional Insurance Options

Firefighters in the UK can explore several additional insurance options. Critical Illness Cover pays a tax-free lump sum if you are diagnosed with a serious illness.

This gives much-needed support during tough times.

Terminal Illness Cover offers an early payout if you face a terminal diagnosis, easing financial stress for your family.

Income Protection Insurance is another valuable option. It provides up to 70% of your regular income if you cannot work due to illness or injury.

Family Income Benefit (FIB) ensures that your loved ones receive monthly tax-free payments if something happens to you during the policy term.

These choices help ensure financial stability for firefighters and their families after unexpected events occur.

Impact on Premiums for Life Insurance For Firefighters

Life insurance premiums for firefighters can vary. Factors like health, age, and work risks affect the costs.

Factors affecting premiums

The cost of life insurance can be high for firefighters. Several factors influence these premiums.

- Occupation Risk: Firefighting is a high-risk job. Insurers see it as dangerous due to exposure to fire and hazardous materials. This often leads to higher premiums.

- Health Status: A firefighter’s health plays a significant role in pricing. Conditions like heart disease or respiratory issues can raise costs.

- Age: The applicant’s age also affects the premiums. Older individuals usually face higher rates because they have increased health risks.

- Smoking Habits: Smokers typically pay more for life insurance. Smoking raises the chances of serious health problems, which leads to increased premiums.

- Coverage Amount: The total sum insured impacts the cost. More coverage means higher payments.

- Policy Type: Different types of policies come with varying costs. For example, term insurance might be cheaper than whole life insurance, affecting premium amounts.

- Living Conditions: Where a firefighter lives can also matter. Areas with high crime rates or poor access to healthcare may cause insurers to increase premiums.

- Previous Declines: If someone has faced declines from previous insurers, this history may affect current rates negatively.

- Claims History: A history of making multiple claims can signal higher risk and lead to steeper prices on new policies.

Understanding these factors helps firefighters choose better coverage at acceptable costs while considering the financial security for their loved ones in times of need.

Importance of comparing quotes for the best deal

Comparing quotes for life insurance is key for firefighters. Prices and benefits can vary widely between insurers. Some companies may offer better coverage options or lower premiums.

You can find a policy that fits your needs and budget by shopping around or, even better, using our bespoke comparison service.

It’s wise to take your time with this process. Look at all the details in each quote, including coverage amounts, terms, and exclusions.

Finding the right life insurance is crucial for peace of mind for you and your family as a firefighter facing unique risks on duty.

It would be best to have a plan that protects what matters most—your loved ones’ financial security.

Assistance for Firefighters Seeking Life Insurance

Firefighters can find help when looking for life insurance. Some insurers focus on high-risk jobs and offer coverage that suits their needs, even if they have existing health issues or past refusals.

Specialised insurers offering coverage for high-risk applicants

Specialised insurers provide life insurance for high-risk applicants like firefighters. These companies understand the unique risks that come with the job.

Premiums can start at around £15 a month, making it more accessible for those in this field.

Chimat offers life insurance specifically designed for firefighters. Such policies help ensure financial security for their families in case of an unexpected event.

Insurers consider factors such as age, health, and smoking status when offering coverage. They aim to meet the needs of firemen while addressing concerns about hazardous work environments and health risks associated with firefighting duties.

This makes finding suitable coverage easier for fire brigades across the UK.

Support for those with pre-existing medical conditions or previous coverage declines

Firefighters with pre-existing medical conditions often face challenges in securing life insurance. Common issues include a history of illness or past declines due to health concerns.

Insurers may see these factors as risks, making securing coverage more challenging.

Chimat offers help through its impaired risk team. The team specialises in assisting firefighters who have previously been denied coverage.

This team understands the unique needs of firefighters and works with various insurers who offer policies for high-risk applicants.

With their support, individuals can find suitable plans that cover essential aspects like critical illness insurance and financial security for loved ones.

Life insurance is vital for firefighters.

It offers peace of mind and financial security for their families. This coverage supplements workplace benefits like ‘death in service’. Firefighters face unique risks, so getting the right policy is important.

They can find the best deal to protect their loved ones by comparing quotes.