Young adults often don’t prioritise life insurance. College, work, and social life usually take priority, which is understandable.

At Chimat, we’ll explain clearly why affordable life insurance for young adults matters, how it works and what options suit you best.

Some points you should consider:

- The younger you buy life insurance policies for young adults, the cheaper your premiums will be.

- Affordable monthly premiums that stay low for the entire length of your policy (often starting at under £5 per month).

- Getting covered could become difficult or more expensive if your health deteriorates later. Taking out a policy now means you’re protected, no matter what happens later.

- Taking out life insurance early is a sensible financial move that helps you develop long-term habits like planning, saving, and protecting your future.

- If you have co-signed student loans or other debts, life insurance can prevent those financial burdens from falling on your family or loved ones if something happens.

- You may not have dependents yet, but a policy can cover funeral expenses and other final costs—sparing your family from unexpected bills during an already difficult time.

Life Insurance For Young People. Compare Plans From Leading UK Insurers Today

Try Our Young Persons Life Insurance Policy Suggestion Tool Below:

Why Should Young Adults Consider Life Insurance?

Taking out life insurance while young can save you a lot of money. It also gives peace of mind, knowing you’ve planned ahead for yourself and those who rely on you.

Financial security for dependents

Life insurance for young adults in the UK is vital to protect family finances. Dependents like partners or children may depend on your income for day-to-day living.

The costs of mortgage repayments (average debt £134,368), rent (£1,302/month), and childcare (up to £120.83/week) quickly add up.

Life insurance options for young adults, like term life or whole life policies, can ease this financial strain if you pass away suddenly.

Funeral expenses alone are high—the average basic funeral costs around £4,141, with total costs of death nearer £9,658.

Good life insurance for young adults ensures that these big bills won’t fall onto loved ones who already face a tough time emotionally.

Planning ahead helps families cope with the unexpected.

Lower premiums at a younger age

Getting life insurance early means you pay less each month. A healthy 20-year-old non-smoker in the UK can get £400,000 of term life insurance for just £10.04 per month over 25 years.

The same cover bought at age 40 costs around £39.01 a month—that’s almost four times more expensive.

Premiums rise quickly as you grow older because insurers see more risk with age and health changes.

If you’re under 30 and in good health now, cheap life insurance for young adults starts from about £5 a month. It can provide up to £237,000 coverage over 20 years.

Chimat also has access to life insurance quotes for people over 30. As you can see from the table below, the policy costs are still very reasonable, with decreasing coverage available at around £6 per month.

Buying earlier locks in these low prices making it a wise financial decision for your future budget.

Here’s a sample price comparison between a level term life insurance policy and a decreasing term policy.

The quotes are based on £100,000 of coverage over a 30-year term for a healthy individual who doesn’t smoke.

| Your Current Age | Level Term Life Insurance | Decreasing Term Life Insurance |

|---|---|---|

| 20 | £4.92 | £4.57 |

| 25 | £5.36 | £4.89 |

| 30 | £5.91 | £5.46 |

| 35 | £7.96 | £6.15 |

Types of Life Insurance for Young Adults

Getting the right cover can seem tricky as there are more choices than you might think. Let’s clarify key options so you know what best fits your needs.

Term life insurance

Term life insurance for young adults gives cover within a set time, like 10 or 20 years. You pay low premiums each month—at age 20 this can be as cheap as £4.50–£4.93 per month—and get fixed payouts if you pass away during that period.

The best term life insurance for young adults offers financial security for loved ones without high costs.

Term life insurance is simple protection at an affordable price—a wise choice in your early adult years.

Decreasing term insurance

Unlike term life insurance, decreasing term insurance offers a payout that goes down over time.

Young adults often choose this plan to cover big debts like mortgage loans. The sum you owe reduces each year, and the policy matches this drop.

Click To Compare QuotesFor instance, if you’re 20 years old, your premium could be quite cheap at around £4.58 to £4.70 per month and decrease as your loan clears. Decreasing term plans are among the cheapest life insurance options for young adults in the UK since risk levels fall alongside debt repayments.

Whole life insurance

While decreasing term insurance costs less over time, whole life insurance offers lifelong coverage with a guaranteed payout.

A whole life policy pays your loved ones whenever you pass away as long as payments are up to date. Many young adults see this as financial security for dependents who may rely on them.

Premiums remain fixed, though they’re higher than those of a term plan because the insurer guarantees payment at some point.

For example, suppose you’re healthy at twenty-five and sign up for the best whole life insurance for young adults from reputable companies like Aviva or Legal & General. In that case, you’ll benefit from lower premiums locked in early.

You will, however, still pay more each month compared to basic term policies offering temporary cover.

From personal experience starting early helps ease future financial burdens by spreading out larger lifetime costs into manageable monthly amounts right now.

Critical illness

Whole life insurance is one option, but critical illness cover offers extra peace of mind. This type of policy gives financial protection if you’re diagnosed with a serious illness, like cancer or heart disease.

It can be added to an existing life insurance policy or bought separately from top insurers in the UK market such as Aviva, Legal & General and Vitality.

You’ll receive a set amount after diagnosis—money you can use freely for bills, medical treatment or living costs while unable to work.

Critical illness cover protects your finances during tough times so you can focus on recovery.

Family income benefit

Critical illness cover gives a lump sum if you become seriously ill—but family income benefit protects your loved ones in another way.

This type of plan pays out monthly, from £500 up to £5,000 each month, for a set number of years if you pass away during the policy term.

Click To Compare QuotesRegular payments help families manage bills and long-term budgets more easily than one big payout. The best life insurance plans for young adults offer steady support like this for peace of mind.

What type of life insurance is best for young adults?

- Term life insurance is often the best type of life insurance for young adults in the UK. It’s cheaper than whole life cover and offers clear, simple protection for a fixed period from 10 to 30 years. Term plans are popular with single young people or couples who rent homes or have new mortgages, as they match their financial commitments and budget needs.

- Decreasing term insurance also suits those with repayment mortgages, as payout sums decrease alongside mortgage balances.

- Family income benefit policies pay regular monthly amounts rather than one large lump sum—ideal if you prefer steady support to help loved ones with bills or childcare costs.

Consider your money goals, dependents, and lifestyle carefully before choosing the best life insurance policy for young adults.

When should young people get life insurance?

We are often asked when is the most appropriate time to buy life cover. Getting life insurance at an early age ensures long-term affordability and lower premiums.

The best life insurance policies for young adults often cost far less if bought in their 20s compared to waiting until later years.

For example, a healthy non-smoker aged 25 could pay around £6-£10 per month for basic term cover, while the same policy might cost double that amount by age 35 or older.

Young people who plan ahead can easily adjust their guaranteed life insurance as they go through milestones like marriage, buying a home or having children—key events that change financial needs.

Choosing an affordable life insurance policy for young adults starts with thinking about your own goals and family plans: are you single now but considering settling down in future? Do you already have dependents reliant on your income?

Premium rates rise steadily as we age, and sudden health issues make coverage expensive or even unavailable, so securing affordable protection early helps lock in predictable costs over decades.

Someone in their 40s will likely pay significantly more for coverage than someone who is 35.

Deciding what affects premium prices is another smart step toward getting ideal coverage; let’s find out more about these factors next.

Factors That Affect Life Insurance Premiums

Your health profile, habits and job can all change the price you’ll pay—learn what matters most before you decide.

Age and health

Your age and health affect what you’ll pay for life insurance quotes for young adults. At a younger age, premiums stay lower as your risk of illness is less.

A 20-year-old in the UK can get level term life insurance at around £4.50 to £4.93 per month, but by age 25 that rises slightly to between £5.26 and £5.38 monthly—still affordable if you start early.

Personal health matters, too; insurers consider your medical history before they decide on a price for guaranteed life insurance for young adults.

Being fit and healthy gets cheaper cover, while issues like smoking or ongoing treatments increase costs quickly—and sometimes sharply—as I learned myself when comparing prices with friends who smoked versus those who didn’t!

Keeping track of your health now pays off later through cheaper premiums from some of the best life insurance companies for young adults in the UK market today.

Lifestyle and occupation

Life insurance firms in the UK closely check your hobbies and job. Smokers pay higher premiums because of greater health risks, even young smokers around age 20—£10.04 per month for non-smokers compared to £15.80 monthly for smokers.

Work also matters: Police officers or firefighters usually face slightly higher costs due to daily dangers, unlike office workers with safer jobs who often get cheaper deals on life cover.

Even the cheapest life insurance for young adults depends heavily on these points.

Make sure you pick a plan that matches your lifestyle from the best life insurance company for young adults.

Next, let’s explore joint life policies versus two single ones—which is better?

Joint life insurance vs two single policies for young people

Young people in the UK can choose between joint life cover or two single policies.

- Joint life cover offers lower premiums monthly (£5.72 at 20, compared to £7.00 for two single policies).

- At age 25, costs move closer (£8.08 joint policy vs £8.72 two singles).

- With joint policies, coverage ends once the first person passes away.

- Single policies have separate payouts—one claim doesn’t end the other’s cover.

- Couples should consider their future needs—mortgages, children, or personal debts—when choosing between joint and single cover.

- Critical illness cover can be added to either joint or single policies—protecting finances if serious illness strikes.

- Family income benefit is a different protection option, paying monthly income to dependents rather than one lump sum.

Our Summary Points

Life insurance might seem less urgent at your age, but getting it now means lower premiums later.

Whether you choose term cover, whole life, or critical illness protection from providers like Legal & General or LV, you’ll secure financial peace for loved ones.

Assess your current health and lifestyle habits to find a policy that’s right for you. Don’t wait until you’re older and costs rise.

Chimat can help you explore your options today to lock in affordable rates and steady protection.

FAQs

1. Is life insurance necessary for young adults in the UK?

Well, it depends. Life insurance for young adults isn’t always essential, but it’s often wise. Even if you’re single and healthy, having cover early can protect your loved ones from debts or funeral costs later on.

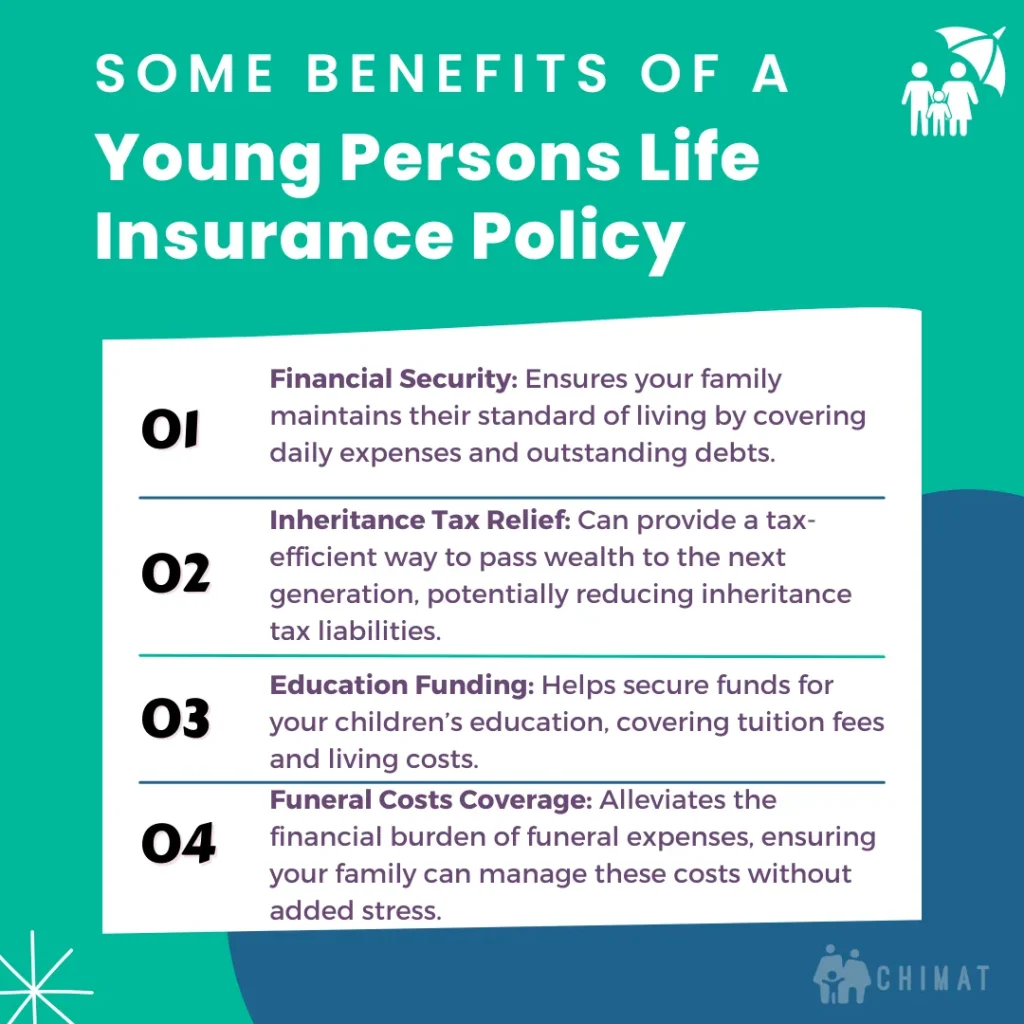

2. What are the main benefits of life insurance for young adults?

The key benefits of life insurance for young adults include lower premiums when you start early, financial security for family members if something happens to you, and peace of mind knowing you’ve planned ahead.

3. Is life insurance a good investment for young adults who are single?

Life insurance isn’t an investment as such, but getting it while you’re single and younger usually means cheaper long-term rates. Additionally, some policies accumulate cash value over time, making it worthwhile.

4. How do I choose the best life insurance for young adults in Britain?

To find the ideal life insurance policy for a young adult, we can help by comparing plans carefully online first. We closely examine coverage amounts, monthly costs, and flexibility options to match your lifestyle needs before deciding what’s right for you.

5. My boyfriend’s Dad is in his late 60s and thinking about life insurance coverage. What do you suggest?

If he is in good health, he may still qualify for affordable life insurance options, such as term or whole life coverage.

It’s wise to compare over 60s policies and consider what the coverage is intended to achieve, such as covering final expenses or leaving an inheritance.