Taking out Life insurance over 40 is sensible due to increased financial responsibilities as we get older.

At this stage, mortgages, children’s education, and long-term financial security become more important.

Some may worry that getting a policy later in life will be too expensive or complicated, but that isn’t necessarily the case.

Benefits Of Buying Cover At This Life Stage

- Premiums can start from under £9 per month. For example, Prudential offers £100,000 Level Term coverage at £8.68 monthly for non-smokers aged 40. Rates rise with age or smoking habits.

- Choosing policies in your early 40s locks in fixed rates. This protects you from rising prices as consumer costs climb.

Please complete the quick quote form below to determine how much you can save

Why is life insurance important for those over 40?

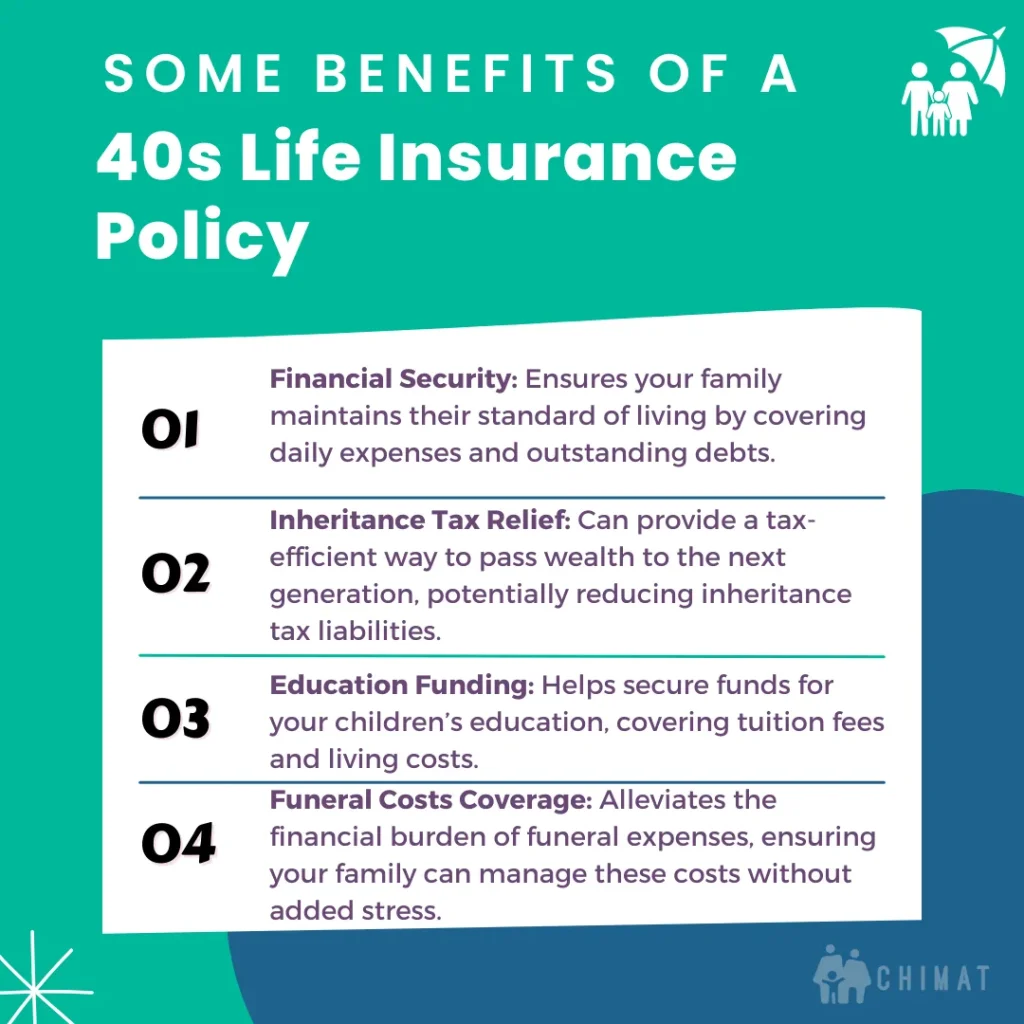

Life insurance provides financial protection and security for family members, ensuring stability in case of unforeseen events.

Life insurance is a financial safety net, covering outstanding debts and living expenses for families left behind.

It’s not just about paying off a mortgage or funding education; it’s about ensuring your family can maintain their standard of living.

Parents can use life insurance to create a financial legacy, ensuring future peace of mind and care for their children.

Knowing that your loved ones are protected can help you focus on enjoying life and making the most of your time with them.

Financial security and emotional comfort make life insurance indispensable to a comprehensive financial plan.

When should you take out life insurance? This is a valid question, and getting covered in your forties makes financial and moral sense. As we discuss below, premiums are still low for this age group.

Life insurance costs for over 40s

Life insurance costs tend to increase with age, so securing a policy early can help lock in lower premiums.

Factors such as health, lifestyle, and the type of coverage also influence the price of life insurance premiums.

For instance, maintaining a healthy lifestyle can positively impact premium rates, while a history of smoking can lead to higher costs due to increased risk.

For individuals aged 40-49, the cost of level term life insurance can vary depending on personal circumstances.

Choosing a decreasing term policy can often result in lower premiums compared to level term policies.

However, some insurers may charge higher premiums or exclude certain conditions based on individual assessments.

To manage life insurance costs effectively, consider your overall health, financial obligations, and the type of coverage that best suits your needs.

Chimat can help you compare quotes from various insurers to find the most affordable life insurance cost premiums without compromising on coverage.

The following table provides a cost comparison of level-term life insurance for individuals between the ages of 40 and 49.

The quoted rates apply to a healthy, non-smoking applicant seeking a 20-year level term policy with £100,000 in coverage.

| Age | Insurer (Prudential) | Insurer (Legal & General) |

|---|---|---|

| 40 | 8.68 | 9.12 |

| 41 | 9.17 | 10.36 |

| 42 | 9.67 | 11.45 |

| 43 | 10.46 | 12.33 |

| 44 | 11.22 | 13.24 |

| 45 | 12.14 | 14.35 |

| 46 | 13.48 | 15.61 |

| 47 | 14.85 | 17.23 |

| 48 | 15.24 | 18.64 |

| 49 | 17.52 | 20.19 |

Types of life insurance policies available for over 40s

For those over 40, there are two main types of life insurance policies: term life insurance and whole life insurance.

Understanding the benefits and considerations of each helps align them with your financial goals and needs.

When selecting a life insurance policy, consider factors like the duration of coverage, individual financial needs, and health conditions.

Term life insurance

Term life insurance provides coverage for a specified period, ranging from 5 to 50 years for those over 40.

Due to its affordability and flexibility, this type of policy is particularly recommended for individuals entering their 40s.

Term life insurance allows you to choose the coverage amount and the policy end date, tailoring it to your specific needs.

It is ideal for covering mortgage payments, education fees for children, and other significant debts.

It offers substantial life insurance coverage at relatively low premiums, making it a popular choice among those looking for guaranteed life insurance financial protection without breaking the bank.

For example, John and Sarah, a couple from Swindon, selected a term life insurance policy to ensure their mortgage would be paid off if either passed away unexpectedly.

Whole life insurance

Whole life insurance provides lifelong coverage, ensuring financial protection for as long as you live.

One of its beneficial characteristics is that the policy does not have an end date and lasts a lifetime, providing peace of mind that your beneficiaries will receive a payout no matter when you pass away.

This type of insurance is particularly suited for those looking for permanent protection and cash value growth.

Whole life insurance also benefits individuals with existing health issues or high-risk hobbies, offering coverage despite these factors.

David and Emily Williams, for example, chose whole life insurance to meet their need for lifelong protection and to provide a financial legacy for their children.

However, it is advisable to take out whole life insurance early, as delaying can lead to higher costs due to ageing.

Features of term life insurance for those over 40

Term life insurance provides coverage for a specific period, often aligning with financial responsibilities such as mortgages or children’s education.

Its flexibility allows policyholders to choose from level term, decreasing term, or increasing term life insurance, each catering to different needs.

The lump sum can increase with inflation, maintaining its value over time.

Level term life insurance

Level-term life insurance is a type of coverage in which the premium and coverage amount remain constant throughout the policy term.

This predictability ensures that beneficiaries receive a fixed amount if the policyholder passes away during the term. For instance, a lump sum is chosen for a fixed term, with premiums remaining constant until the policy ends.

Click To Compare QuotesThis type of insurance is ideal for those seeking predictable expenses, as the premiums and coverage amount are fixed for the entire policy duration.

If the policyholder dies while covered, their family receives a cash sum for financial support.

Decreasing term life insurance

Decreasing term life insurance is designed to assist with mortgage repayment and offers protection throughout the loan period.

With this type of policy, the coverage amount decreases over time, mirroring the decreasing balance of the mortgage. This makes it ideal for covering a capital and interest repayment mortgage.

The sum assured declines throughout the policy, ensuring coverage aligns with the outstanding mortgage balance.

Decreasing term life insurance is often cheaper than level term policies, providing cost-effective financial protection for homeowners.

Increasing term life insurance

Increasing term life insurance adjusts coverage to match inflation, ensuring the payout value grows over time. The sum assured grows with inflation based on the Consumer Price Index, providing beneficiaries with substantial value.

However, this type of insurance is typically more expensive than other life insurance types due to the increasing coverage.

Despite the higher cost, it is a valuable option for those looking to maintain the purchasing power of their life insurance payout over time.

How much life insurance cover do you need?

Determining how much life insurance coverage you need involves considering factors such as family protection, mortgage, debts, and other financial obligations.

You must assess the anticipated dependency duration for those relying on your income and factor in any existing death in service benefits.

A life insurance calculator can help you accurately assess all financial commitments and determine the appropriate coverage amount. This ensures you purchase sufficient coverage without incurring unnecessary monthly expenses.

Comparing quotes from various insurers is crucial to finding optimal coverage at competitive prices.

Critical illness cover for over 40s

Critical illness cover is particularly beneficial for individuals over 40 due to the increasing health risks as we age.

This type of cover provides a lump sum if diagnosed with serious illnesses like cancer or heart attack, helping manage living expenses and mortgage payments during recovery.

Adding critical illness cover to a life insurance policy can offer additional financial security and peace of mind. If you’re considering this option, you may wonder how much cover you need.

Critical illness coverage can be added to life insurance, though pre-existing conditions may raise costs.

Click To Compare QuotesPre-existing conditions refer to any health issues that exist before applying for life insurance and potentially affect coverage. Therefore, it’s important to consider these factors when securing critical illness coverage.

Joint life insurance vs. single life insurance for the over forties

Joint life insurance covers two lives simultaneously and pays out only once upon the death of either partner, after which the policy ends.

This type of policy is typically more cost-effective than obtaining two individual life policies, making it an attractive option for couples. When the first partner dies, the policy pays out and ends, requiring the surviving partner to obtain new coverage.

In contrast, single life insurance policies allow individuals to maintain separate coverage that continues even after the death of one partner, providing ongoing financial protection.

This can be particularly important for families who want to ensure continuous coverage and financial security.

When deciding between joint life insurance and single life insurance, consider your circumstances, financial goals, and the level of financial protection you want to provide for your family members.

Both options have advantages and limitations, so choosing the one that best fits your needs is essential.

What happens if you outlive your term life insurance policy?

If your term life insurance ends because you’ve outlived it, you must apply for a new policy to continue coverage.

Some term policies allow for conversion to permanent insurance, which can provide ongoing coverage.

This option can be handy for those who still need life insurance protection but want to avoid the higher premiums associated with new term policies.

You won’t be refunded any premiums if you outlive your term life insurance policy. Planning and considering long-term insurance needs helps avoid gaps in coverage.

Securing life insurance with pre-existing medical conditions

While challenging, options exist for obtaining life insurance with pre-existing medical conditions.

Eligibility criteria for life insurance applications typically include age and health status.

While guaranteed acceptance life insurance without medical exams is not available for individuals over 40, most life insurance applications do not require a medical exam, making it easier for people with health concerns to obtain coverage.

Some insurers have specialised programs that cater to those with pre-existing medical conditions, providing coverage options that fit their needs.

Disclosing your medical history when applying for life insurance is crucial; failure to do so can lead to denied claims later.

A financial adviser can help you explore options and find the best coverage.

Tips for finding the best life insurance policy over 40

Consider your overall health, financial obligations, and family needs to find the best life insurance policy over 40.

Comparing life insurance quotes is essential to ensure you get the right cover at a competitive price.

Getting a life insurance quote through Chimat typically takes around 30 minutes, and you are not obligated to take out cover if it doesn’t feel right for you.

Consider both the cost and the type of coverage that best suits your needs. Not disclosing your medical history when applying for life insurance can lead to claims being denied later on.

Many individuals end up with unsuitable types of coverage or insufficient amounts because they rely solely on shopping comparison websites.

Life Insurance Over 40 Summary

As you move through your 40s, the importance of life insurance cannot be overstated. It provides crucial financial protection and peace of mind, ensuring that your loved ones are secure in the event of your untimely passing.

We’ve explored the various types of life insurance policies available, including term and whole life insurance, and discussed their benefits and key features tailored for those over 40.

Understanding the costs, coverage options, and specific considerations, such as critical illness cover and pre-existing medical conditions, is essential for making an informed decision.

By comparing quotes and assessing your financial needs, you can find the best life insurance policy that offers both affordability and comprehensive coverage.

Common Myths About Getting Life Insurance After 40

It’s Too Expensive

While costs rise with age, many affordable options exist, especially for healthy individuals. Term life insurance, in particular, offers good coverage at reasonable rates.

I Don’t Need It If I Have Savings

Savings can take years to build, while life insurance provides an immediate financial cushion. A policy ensures that loved ones won’t have to deplete savings or sell assets in an emergency.

I Won’t Qualify Due to Health Issues

Even those with medical conditions can find policies. Guaranteed acceptance options, such as over 50s life insurance, provide coverage without health checks.

It’s Only for People with Dependents

Life insurance can help with funeral costs, outstanding debts, or charitable donations, even without children or a spouse.

I’m 38 years old, so I’m not quite 40. Will the coverage be cheaper for me?

Yes, the life insurance coverage in your late 30s will still be very reasonable.

You could get level term life insurance (over a 20-year term) for around £11.23 per month

and decreasing term life insurance (over 20 years) for roughly £8.12 monthly.