Are you expecting a little one soon? As you prepare for this exciting time, have you considered getting life insurance when pregnant?

Pregnancy often triggers thoughts about your family’s future. You start to worry about their well-being if something happens to you.

While you hope for smooth sailing, life insurance ensures your loved ones get financial protection in case of the unexpected.

Here’s what you should know about life insurance during pregnancy to help you make the best decision for your loved ones.

Can You Get Life Insurance When Pregnant?

You can still get a life insurance policy even if you’re pregnant.

Most life insurance companies are open to offering coverage to pregnant women.

Generally, pregnancy shouldn’t affect your premium rates if you’re healthy. However, it can be trickier depending on your circumstances and the provider you choose.

Of course, the sooner you apply and the smoother your pregnancy goes, the higher your chances of getting the cover you need.

So, discuss your situation with insurance experts for personalised guidance and to explore coverage options that fit your needs.

Are you pregnant And Need Life Insurance Coverage? Compare Offers From Top UK Insurers

Should You Tell Your Life Insurance Provider You’re Pregnant?

When applying for life insurance, inform your insurer of your pregnancy. This is essential for getting the coverage that suits you best and keeping everything above board.

Pregnancy and childbirth are usually safe and go without incident. Still, insurers consider them significant medical events because they can cause health complications, which occur in 8% of pregnancies.

Even if these pregnancy complications are temporary, it’s vital to be honest about them.

Failure to disclose your health status could give your insurer reason to deny your beneficiary a death benefit if something unexpected happens to you.

Click To Compare QuotesDealing with the loss of a loved one is hard enough. Missing financial support at such a difficult time would make things harder for your family.

Are You an Existing Life Insurance Policy Holder?

If you have an existing plan and become pregnant, you don’t need to tell your insurer about it.

Your cover already factors in the possibility of pregnancy based on your gender, marital status, and other relevant information.

But, with a baby on the way, it’s a good idea to check if your current protection benefits still meet your needs.

Some insurers let you amend your policy and increase your cover amount when substantial life changes like this happen. Contact your insurer to see if they offer this feature in your plan.

Can You Get Life Insurance When Pregnant With Medical Issues?

Many insurance companies are willing to work with pregnant women with medical conditions.

However, you must be upfront about your medical history and provide as much detail as possible.

Common pregnancy-related complications include gestational diabetes, high blood pressure, and anaemia.

Depending on the severity of your health issues and other risk factors, the insurance company can increase your monthly premiums, delay the application until after childbirth, or decline the application altogether.

It’s worth shopping around to find an insurer who will be more flexible and accommodating to your needs.

How to Apply for Life Insurance When Pregnant

The application process is the same as applying at any other time. You’ll still go through the standard evaluations, plus some pregnancy-related questions.

Here’s what you can expect to talk about with your insurer during the medical underwriting:

Smoking

You must share your smoking history from before your pregnancy for insurance purposes.

Even if you’ve kicked the habit since getting pregnant, insurers will classify you as a smoker if you’ve used the following in the past 12 months:

- Cigarette, tobacco, or pipe (including shisha or hookah)

- E-cigarette or vape, regardless of nicotine content

- Nicotine patch

Alcohol Consumption

Chances are, you’ve skipped those wine nights since learning about your pregnancy. Still, insurers will want to know about your pre-pregnancy drinking habits and how your alcohol consumption has changed over the last five years.

Even if you’ve gone entirely alcohol-free during pregnancy, insurers might still raise your rates based on your previous alcohol consumption.

Click To Compare QuotesWith the rise of alcohol-specific deaths in the UK, excessive drinking flags you as a high-risk applicant.

Insurers could even turn down your application unless you show improvement backed by medical guidance and updated tests.

Occupation

Insurers want to know the kind of work you do day-to-day. If your job involves anything risky, like handling heavy machinery or working in hazardous places, it’s important to tell them.

They need to determine the risk associated with your work even if you’re not doing those tasks right now.

Stage of Pregnancy

You have better chances of getting insured early in your pregnancy. If you’re in the later stages, some insurance companies might wait until your baby arrives to provide cover.

In short, you won’t have insurance during pregnancy and childbirth.

Health Complications

Pregnancy-related complications or pre-existing conditions are primary factors affecting your eligibility or policy premiums.

In this case, you have a couple of options. You can buy life insurance now with a higher premium, then review it later when your medical condition clears up.

Or you can wait until your body returns to pre-pregnancy health to get the cover.

Weight

Insurance companies will also want to know your current BMI (body mass index). A higher BMI might affect your policy terms.

Some insurers, though, will consider your pre-pregnancy weight when looking at your application.

That’s because they understand that your pregnancy weight isn’t a fair measure of your usual weight.

Remember that if your BMI creeps up during your early 30s, your life insurance premiums could also climb.

Types of Life Insurance for Pregnant Women

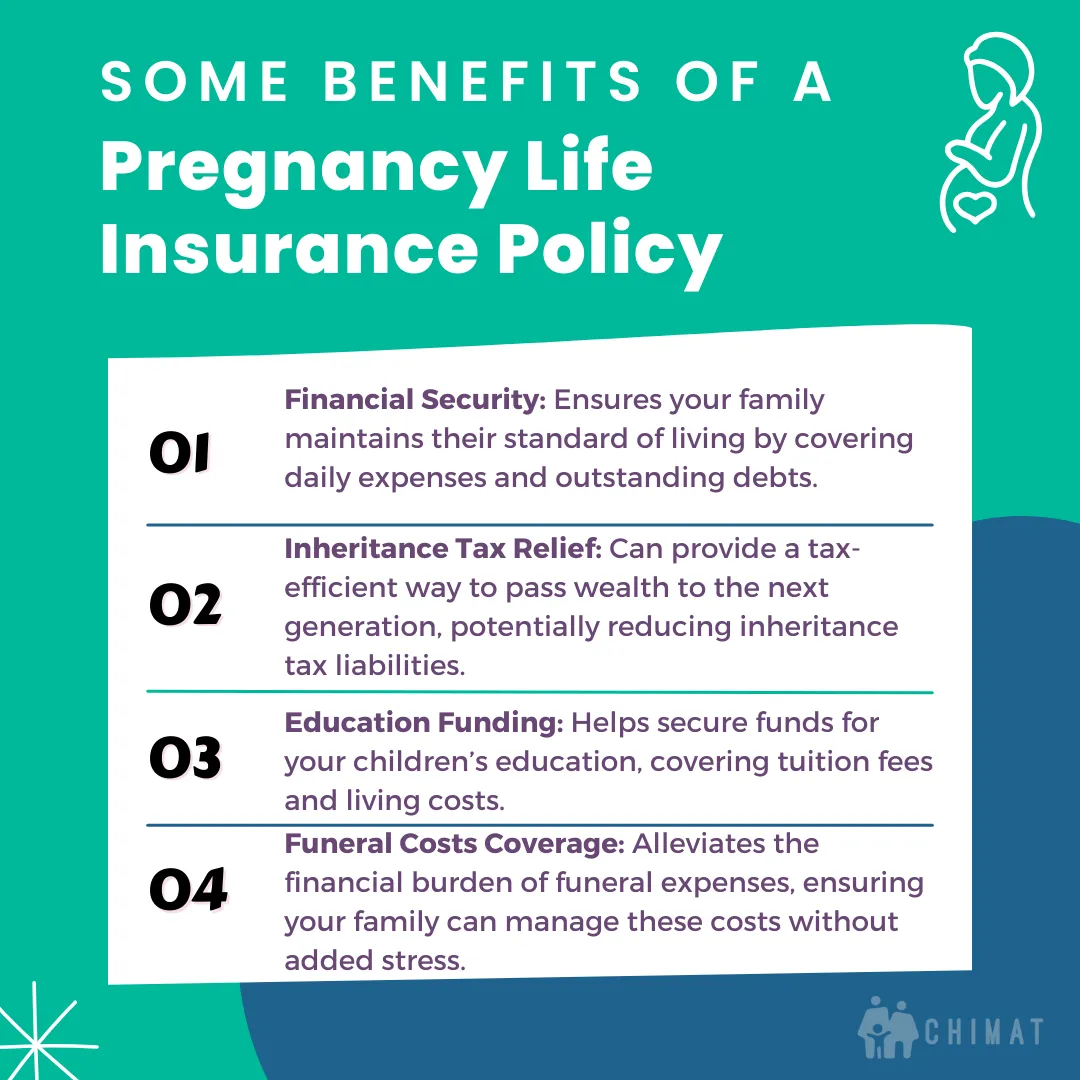

Life insurance can ease the financial stress on your loved ones if you pass away while the policy is in effect.

Your beneficiary can use these tax-free payments to replace lost income or clear out a huge debt.

Click To Compare QuotesYou can even arrange for the payments to go into a trust, ensuring your family gets the funds sooner. This also keeps your payout separate from your estate, exempting it from inheritance tax.

Soon-to-be-parents like you can choose from these options:

Level Term Life Insurance

Level term life insurance keeps things simple—your payments and coverage stay the same for the policy term.

It can be reassuring for your family, especially if they rely on your income to cover everyday living expenses like mortgage, bills, and school fees.

Level term life insurance features:

- A lump sum payout

- Affordable premiums

- Flexible policy length

However, there are a couple of things to consider. While it offers a stable payout, that amount won’t increase with inflation.

Decreasing Term Life Insurance

Are you worried about leaving your loved ones with a hefty mortgage debt if you suddenly die?

Decreasing term life insurance, often called ‘mortgage’ life insurance, can take that weight off your shoulders.

This policy pays out less money over time. Sounds counterintuitive, right? But here’s why it’s designed this way:

A decreasing term life insurance covers the remaining balance of a repayment mortgage. You set up the payout and term to match your loan amount.

If you pass away during that time, the payout should cover what you still owe on your mortgage.

So, the earlier the unfortunate event happens, the more it pays out. If it’s later, it covers less as you near paying off your mortgage.

However, your monthly payments stay the same throughout.

Decreasing term life insurance features:

- A decreasing lump sum amount proportionate to a debt repayment

- Cheaper than level-term life insurance

- Fixed monthly premiums

Family Income Benefit

This type of coverage pays out in monthly instalments if you were to pass away, basically replacing your lost income. It covers essential household costs, childcare fees, mortgage, or rent.

Family income benefit features:

- Ongoing monthly income

- Tax-free payments

- Cheapest life insurance option

Whole of Life Insurance

Whole of life insurance offers lifelong protection for your family. Unlike term life insurance, which covers you for a set period, a whole of life cover lasts for your lifetime.

You can pay these premiums monthly, yearly, for a specific duration, or as a one-time payment.

This plan pays out a lump sum to your beneficiaries, which they can use to pay outstanding debts, funeral expenses, and living costs.

Some insurers even allow you to invest part of your premium, potentially growing its cash value over time.

Plus, you can withdraw some of this cash tax-free without affecting the payout sum.

Whole of life insurance features:

- Lifetime cover

- Guaranteed death benefit

- Higher premiums

Should You Get a Joint Life Insurance?

If you’re with a partner, taking out a joint policy is cheaper than getting two separate plans for the same cover.

The only caveat is that joint life insurance pays only once. If one partner dies, the policy will end, leaving the surviving partner without cover.

Does Pregnancy Affect the Life Insurance Cost?

Assuming you’re in good health overall, your monthly premiums shouldn’t increase just because you’re expecting.

Pregnancy alone isn’t a factor in determining your rates—your health status while pregnant is.

Here’s why your premiums might go up during pregnancy:

- Age

- Weight gain

- Lifestyle factors

- Family medical history

- Pre-existing medical conditions that may lead to a high-risk pregnancy

- Pregnancy-related complications (pre-eclampsia, gestational diabetes, etc.)

- History of complications in previous pregnancies

Whether pregnancy affects term and permanent life insurance rates depends entirely on the insurer’s policies.

To ensure you get the best cover at the best price, choose an insurer who understands these pregnancy nuances and adjust rates accordingly.

Will a High-Risk Pregnancy Affect Your Life Insurance Cost?

Yes, high-risk factors affect your premiums and whether you’ll be eligible at all. Your age, lifestyle, existing health conditions, or pregnancy complications are all considered high risks for an expectant mother.

A high-risk pregnancy won’t raise your premiums if you already have a life insurance plan. But if you’re applying for a new policy and there are health risks for you or the baby during pregnancy, it might mean higher premiums or a lengthier application process.

Finding insurers willing to provide cover might be more challenging, but the Chimat team would be pleased to help.

When Is the Best Time to Buy Life Insurance When Pregnant?

The best time to get insured is as soon as possible after discovering the pregnancy. That’s when you can lock in the lowest premiums because you’re less likely to have health complications that could affect your coverage or rates.

As your pregnancy progresses into the second and third trimesters, things can get more complicated, especially if you develop medical complications.

Insurers pay more attention because of the higher risk of pregnancy complications. It doesn’t mean you can’t get insurance, but there might be more questions and possibly higher premiums and exclusions.

If you’re further along, some insurance companies may wait until your baby is born.

Ideally, the perfect time to buy life insurance is before you start trying for a baby. If you and your partner have shared financial obligations like mortgages and loans, life insurance cover can offer financial protection for your growing family.

How Much Coverage Do You Need if Expecting a Baby?

As an expectant mum, here are some considerations when deciding how much cover you need:

Income

You can figure out how much income replacement you need by multiplying your annual income by the number of years you plan to support your family.

Some sources suggest using the years until your youngest child is 18, but you know that kids often need financial help for longer than that.

Cost of Raising a Child

Knowing the expenses of raising a child can help you determine how much life insurance you need.

According to a 2023 report, raising a child until they turn 18 could cost around £166,000 for a couple and £220,000 for a single parent.

For term life insurance, you could choose a term that ends when your child becomes financially independent.

Mortgage

Your mortgage is likely your biggest financial responsibility. You can opt for enough life insurance to cover the remaining balance, ensuring it’s paid off if something happens to you. This way, your family can continue living in your home.

If you’re renting, consider options like level-term life insurance or family income benefit to cover the monthly payments.

Your Budget

Of course, affordability matters, too. You’ll want a plan you can comfortably pay monthly until your policy term ends or until you pass away.

Remember that Mums life insurance is cheaper when you’re younger and healthier, so it’s wise to get coverage sooner rather than later to secure lower premiums that suit your family’s needs.

Why Should You Get Life Insurance While Pregnant?

It’s sobering that around 26,900 parents with dependent children pass away every year in the UK. That’s a parent gone every 20 minutes, which is heart-wrenching to think about.

Nobody wants to face this reality, but having life insurance can be a lifeline for your kids if the worst should happen.

A life insurance payout can help pay the following:

- End-of-life expenses and funeral costs

- Mortgage repayment or rent

- Living expenses

- Childcare, education, and extracurricular activities

If you find out you’re pregnant, don’t wait too long to get cover. It’s usually more affordable early on.

Even if one parent plans to stay home with the baby, it’s smart for both to have coverage. If the stay-at-home parent dies, the surviving spouse can handle the lost income and keep things financially stable.

Final Thoughts

With everything going on in your life, applying for life insurance when pregnant keeps slipping down your to-do list. It’s time to reconsider your priorities.

Think about the peace of mind that comes from knowing your loved ones will have financial support even if you’re not around.

Explore your options now to ensure you make the best choices for your family’s future well-being.