We are often asked when should you get life insurance and at what age.

The best time to get life insurance is when considering securing financial protection for your loved ones.

Buying life insurance early can save you money and ensure coverage when needed.

The Chimat team examines the best time to get life insurance in the UK. We’ll also discuss the various policy options and what to consider when choosing coverage to help you make smart choices for your family’s financial future.

- Purchasing life insurance early secures lower premiums and substantial coverage, ensuring financial protection for loved ones in the future.

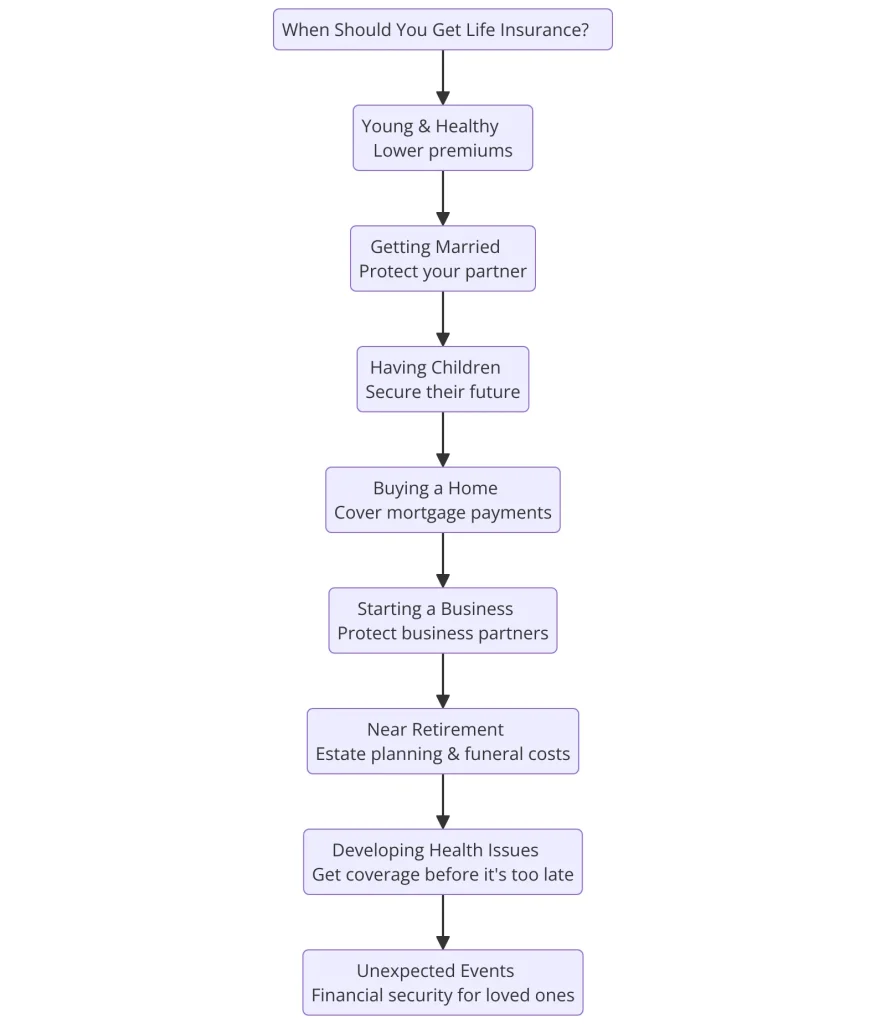

- Key life stages such as marriage, parenthood, and homeownership are important moments to consider buying life insurance, as they reflect increased responsibilities and financial obligations.

- Delaying life insurance can lead to higher costs and potential ineligibility due to deteriorating health, emphasizing the importance of securing coverage while young and healthy.

Please complete the quick quote form below to determine how much you can save.

Why Getting Life Insurance Early Matters

Purchasing life insurance at a younger age can significantly impact your financial protection. One of the main reasons is that younger individuals generally pay lower premiums.

Insurers view them as lower risk due to better health and fewer pre-existing conditions. Lower premiums mean you can secure substantial life cover without straining your budget, providing long-term financial security for your loved ones.

Moreover, securing life insurance early locks in lower premiums for the entire policy duration, protecting you from increasing costs as you age.

Taking advantage of good health when young lowers insurance costs and ensures future coverage, saving money and providing peace of mind.

| Life Event | Importance of Life Insurance |

|---|---|

| Getting Married | Provides financial protection for your partner in case of your passing |

| Becoming a Parent | Ensures your children’s financial security if you’re no longer able to provide for them |

| Buying a Home | Helps cover mortgage payments and protect your home ownership in case of unexpected events |

Key Life Stages to Consider Buying Life Insurance

Life is marked by significant milestones that often come with increased responsibilities and financial obligations.

These key life stages are prime opportunities to consider buying life insurance. For instance, getting married, becoming a parent, or purchasing a home are moments when the need for financial protection becomes more apparent.

If you support others financially, such as siblings or ageing parents, a life insurance policy can ensure their needs are met even after your passing. Life insurance can secure funds for funeral expenses, alleviating the financial stress on your friends and family during a difficult time.

Marriage, parenthood, and homeownership significantly influence the decision to buy life insurance.

Marriage

Marriage is a beautiful journey of sharing your life with someone else, but it also comes with shared financial responsibilities.

Life insurance provides crucial financial support for your partner in case of an unexpected death. Having a life cover ensures that your spouse can maintain their standard of living, pay off debts, and handle daily expenses.

Newlyweds have the option to choose between a single policy or a joint policy. While a joint life insurance policy might seem convenient, it only pays out once, which could necessitate a new policy for the surviving partner.

Therefore, it’s essential to evaluate the pros and cons of each option and decide based on your specific circumstances.

Calculate life insurance needs by considering the duration of your partner’s financial dependency.

Ensure the policy covers the necessary support period. Thoughtful planning prevents financial distress for your loved one, allowing them to focus on healing and moving forward.

| Age Group | Preferred Life Insurance Options | Potential Considerations |

|---|---|---|

| 20-30 years old | Term life insurance | Lower premiums, securing future insurability |

| 30-50 years old | Whole life, universal life, or term life insurance | Comprehensive coverage, building cash value |

| 50+ years old | Guaranteed issue life insurance | No medical exams, coverage for final expenses |

Parenthood

The arrival of children marks a significant turning point in your life, bringing immense joy and new responsibilities.

Many people buy life insurance primarily to secure the future of their children. Life insurance can help cover outstanding debts, ensuring financial burdens do not fall on your family members.

Life insurance provides crucial financial assistance to your children in the event of your unexpected passing, covering daily living expenses, education costs, and other essential needs.

It’s generally advisable to purchase term life insurance at a younger age, particularly when dependents will need income.

Furthermore, policies like level and increasing cover can provide money for your children once they become adults.

When considering life insurance, ensure the coverage lasts until your children complete their full-time education or become financially independent.

Homeownership

Buying a home is a significant financial milestone that necessitates additional protection. Life insurance is often a wise decision to cover mortgage obligations in the event of the homeowner’s death.

This ensures that your family can stay in their home without the burden of mortgage payments.

Selecting the right policy provides financial security for your loved ones and protects your property investment.

Click To Compare Quotes| Age Group | Life Insurance Considerations |

|---|---|

| 20-30 Years Old | Optimal time to secure lower premiums; coverage for starting a family and mortgage |

| 30-50 Years Old | Adjusting coverage as life milestones occur; protecting growing family and assets. |

| Over 50 Years Old | Specialised policies to address retirement planning and end-of-life expenses |

Types of Life Insurance Policies

Understanding the different types of policies available is important.

Life insurance can be broadly categorised into term life insurance and whole life insurance, each serving different needs and financial goals. Knowing which type suits your situation best can help you make an informed decision.

Term life insurance covers a specific period, while whole life insurance provides lifelong coverage. Understanding their unique benefits and considerations helps you choose the right policy for your financial protection needs.

Term Life Insurance

Term life insurance is the most common type due to its affordability and straightforward nature.

It is typically the most affordable option for those looking to cover short-term financial obligations like debts or dependents’ needs. This makes it a popular choice for young families and individuals with mortgages.

Decreasing term life insurance is specifically designed to align with the decreasing balance of a repayment mortgage.

On the other hand, increasing term life insurance adjusts the payout amount over time to keep up with inflation. This ensures that your coverage remains adequate as living costs rise.

Term life insurance is a good option if you have debts or dependents or are considering them in the future. The fixed premiums and cover amounts provide financial security without the complexities of cash value accumulation.

Whole Life Insurance

Whole life insurance offers lifelong coverage with a guaranteed payout to beneficiaries whenever the insured passes away.

Unlike term life insurance, whole life policies do not have a fixed term and provide permanent coverage. This can be particularly advantageous for those looking to leave a legacy or ensure long-term financial protection for their loved ones.

One of the key benefits of whole life insurance is the cash value component, which grows over many years and can serve as a financial resource.

Younger policyholders benefit from a longer time to accumulate this cash value, which can supplement retirement income or cover unexpected expenses.

However, it’s important to note that because whole life insurance provides lifelong coverage, premiums are typically higher than those for term life policies.

Buying whole life insurance early allows significant cash value accumulation, offering financial security and future flexibility.

| Factor | Impact on Premiums |

|---|---|

| Age | Premiums increase by 8-10% per year |

| Gender | Women pay lower premiums than men |

| Smoking Status | Smokers pay more than double the premiums of non-smokers |

| Family Medical History | A History of serious conditions can lead to higher premiums |

| Occupation | Riskier jobs result in higher premiums |

| Lifestyle | Engaging in dangerous hobbies or risky behaviour increases premiums |

| Health Status | Pre-existing conditions can lead to higher premiums |

The Financial Consequences of Waiting

Delaying the purchase of life insurance can have significant financial consequences. One of the primary issues is the increase in premiums as you age.

Insurers consider age a significant risk factor, and waiting to buy life insurance means facing higher costs due to age-related rate increases.

In addition to higher premiums, postponing life insurance can complicate securing an affordable policy if health problems deteriorate.

Deteriorating health can raise life insurance rates or make individuals ineligible for coverage. Some insurers offer specialised policies for those with existing health issues, but these often come at a higher cost.

Special Considerations for Young Singles And Adults

Even if you’re young and single, there are still compelling reasons to consider life insurance. For many young singles, the thought of starting a family in the future can influence the decision to buy life insurance.

Securing a policy at a younger age locks in lower premiums and ensures coverage as life circumstances change.

As a young person, Chimat can offer some of the cheapest life insurance policies for young adults. These include affordable coverage from household names such as Aviva, Vitality, AXA, Legal and General, and lesser-known specialist insurers.

Click To Compare QuotesMoreover, individuals without dependents might still consider life insurance to cover unsecured debts like credit card balances that must be paid upon death.

Waiting too long to purchase life insurance can result in higher costs and potential difficulty getting approval. Thinking ahead and securing insurability early is a wise financial move.

Life Insurance for Children

Parents buy life insurance for their children to ensure financial security in unexpected events. Purchasing life insurance early after birth secures future insurability, providing peace of mind and protection.

In the unfortunate event of a child’s death, life insurance covers funeral costs and related expenses. Most children’s policies are whole life, offering permanent coverage and transferable ownership upon adulthood for continued financial security.

Evaluating Your Coverage Needs

Evaluating your life insurance coverage needs involves considering various factors. Start by assessing how long you want your coverage based on your dependents’ needs and financial independence timeline.

If children are part of your coverage considerations, calculate the duration of their dependency or education.

Assess regular family expenses to estimate the financial support needed for your loved ones after you leave money.

Adjusting for existing savings or investments can lower the required life insurance cover amount. Lastly, include any outstanding debts, like a mortgage, in your calculations to ensure full coverage.

How Lifestyle and Health Affect Premiums

Your lifestyle and health play significant roles in determining life insurance premiums. Age is a critical factor, with younger individuals typically facing lower premiums. Health conditions, especially chronic illnesses, can increase premiums due to increased risk.

Occupation and lifestyle choices also influence life insurance costs. High-risk jobs and habits like smoking or excessive drinking can significantly raise premiums. Conversely, regular exercise and a healthy diet can help lower premiums by improving overall health.

Maintaining a healthy lifestyle benefits your well-being and ensures more affordable life insurance.

Reviewing Your Policy Over Time

A periodic review of your life insurance policy ensures it meets current needs. Life events, like mortgage changes or shifts in financial situation, necessitate policy reviews to maintain adequate coverage.

For individuals aged 50 and above, life insurance often focuses on leaving a cash sum for family or covering funeral costs. Regular reviews help adjust coverage to align with current life stages and financial goals.

Should you get life insurance in your 30s?

Getting life insurance in your 30s from Chimat usually guarantees lower premiums and ensures financial protection for your dependents. It’s a practical step if you have debt, a mortgage, or people who rely on your income now or in the future.

Buying Cover In Your Forties

Buying life insurance in your 40s is a smart choice because premiums are still affordable, and it ensures financial protection for your loved ones. At the same time, you’re likely at a peak in career and family responsibilities.

When Is It Too Late to Get Life Insurance?

While it’s always advisable to get life insurance early, it’s never truly too late. Most life insurance policies are available to individuals until they reach 80 years of age.

Over 50 life insurance policies can provide guaranteed acceptance without medical underwriting.

Although securing coverage becomes more challenging and costly as you age, many still find it worthwhile for peace of mind.

Over 50s life cover allows individuals between 50 and 80, with a maximum age of 80, to leave financial support for their families and cover funeral expenses.

Consider your family’s financial situation if you’re wondering how much coverage you might need.

When Should You Get Life Insurance Summary

Securing life insurance early can provide significant financial protection and peace of mind. Key life stages such as marriage, parenthood, and homeownership are prime opportunities to consider buying life insurance.

Understanding the different types of policies and evaluating your coverage needs ensures that you choose the right life insurance policy for your circumstances.

Whether you’re young and single, a parent, or approaching retirement, life insurance is a crucial tool for securing your financial future.

Don’t wait—assess your needs and take action to protect your loved ones today.

Research Sources:

- Under-35s ‘missing protection milestones (Cover Magazine)

- Family and Life Insurance Purchase Decision-Making (Research Gate)

- Life Insurance for your family (Legal And General)